SRI and ESG Investors on Advocacy and Shareholder Engagement

SRI and ESG Investors on Advocacy and Shareholder Engagement

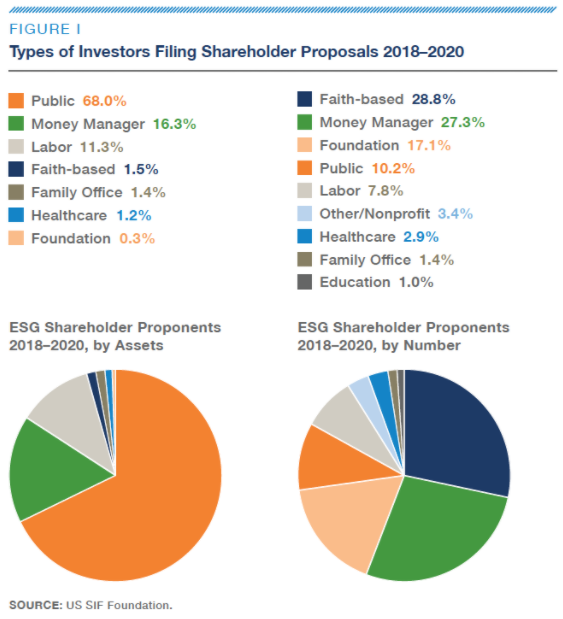

From 2018 through the first half of 2020, according the the US SIF on Trends Sustainable and Impact Investing Trends, 149 institutional investors and 56 investment managers collectively controlling nearly $2.0 trillion in assets at the start of 2020 filed or co-filed shareholder resolutions on ESG issues.

The leading issue raised in shareholder proposals, based on the number of proposals filed, from 2018 through 2020, was corporate political activity. Investors filed 270 proposals on this subject from 2018 through 2020. These resolutions focused on company contributions aimed at influencing elections or on corporate lobbying to influence laws and regulations. Many of the targets were companies that have supported lobbying organizations that oppose regulations to curb greenhouse gas emissions as well as equal opportunity labor issues.

Interestingly, here are the types of investors filing Shareholder proposals and leading ESG engagement issues (charts included) - https://greenmoney.com/sri-and-esg-investors-advocacy/

======