Sustainable Investing at KKR

OUR COMMITMENT AND APPROACH1

Sustainable investing is a key lever of KKR’s approach to value creation and a way of doing business that we believe helps us make better investments. By assessing and managing ESG, regulatory, and geopolitical issues, we strive to create stronger, better business outcomes while also having a positive effect on the companies in which we invest and our stakeholders.

As sustainable investing practices accelerate, a vast lexi- con of terminology continues to develop around them. At KKR, we seek to bring clarity to a confusing landscape by sharing the definitions of our key terms.

To learn more, see the Glossary.

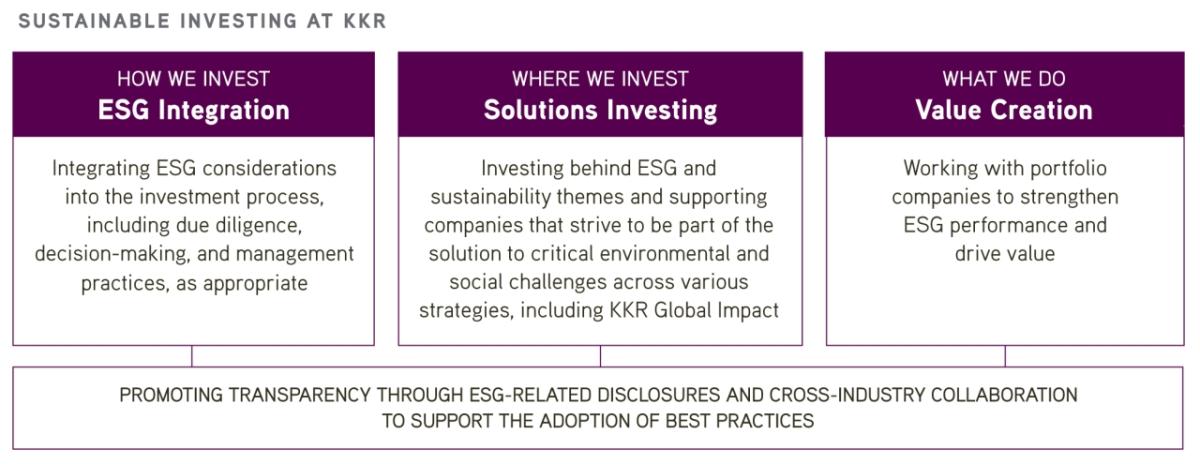

SUSTAINABLE INVESTING AT KKR

HOW WE INVEST: ESG Integration

Integrating ESG considerations into the investment process, including due diligence, decision-making, and management practices, as appropriate

Learn more at ESG Integration Across Asset Classes.

WHERE WE INVEST: Solutions Investing

Investing behind ESG and sustainability themes and supporting companies that strive to be part of the solution to critical environmental and social challenges across various strategies, including KKR Global Impact

Learn more at Spotlight: KKR Global Impact Strategy.

WHAT WE DO: Value Creation

Working with portfolio companies to strengthen ESG performance and drive value

Learn more at Global Ambitions and Driving Value Creation.

PROMOTING TRANSPARENCY THROUGH ESG-RELATED DISCLOSURES AND CROSS-INDUSTRY COLLABORATION TO SUPPORT THE ADOPTION OF BEST PRACTICES

Learn more in the Appendix.

Read the full 2021 Sustainability Report.

1 There can be no assurance that KKR's ESG policies and procedures as described herein will continue, and KKR's ESG policies and procedures could change, even materially. See additional disclaimers in the Cautionary Statement.