Three Tough Questions for an Uncertain Global Gas Market

By Deepa Poduval, Senior Managing Director, leading the Oil & Gas and Mining practice within Black & Veatch Management Consulting.

Increasing global gas supply from newer producers like the United States, demand growth from developing economies in Asia, policy choices supporting cleaner energy sources the world over, lowered costs of renewables, and significant geopolitical shifts are reshaping the global natural gas market.

But the rise of renewables holds a special footing in this conversation. Renewable energy sources are the darling of the global discussion around sustainable power generation. As their prices drop and capabilities mature, solar, wind and other distributed energy technologies are taking an increasingly prominent position in the energy mix and creating new dynamics for stakeholders to consider. At a recent conference of oil and gas industry participants in Spain, we posed three blunt questions:

● Is natural gas the bridge to our energy future — a cleaner-energy connection that helps move us from fossil-based generation sources to a future of global energy primarily sourced from renewables?

● Is it the destination — an acknowledgment that natural gas is here to stay, given its extended low-price cycle, abundance, mature supply chains and ability to complement a renewables strategy?

● Or is it a has-been — a solution whose need has been surpassed by the increasingly robust toolsets of renewable energy resources?

We can say with some certainty that the “has-been” label is too strong and vastly understates natural gas’ current global importance. Natural gas is attractive to developing economies and emerging markets in ways that renewables cannot currently match, particularly in price and potential access

to supply. Competing factors make answers to those questions less than absolute, however, and what is clear is that the long-term dominance of natural gas is in question and bears watching by stakeholders.

An Approaching Solar Storm?

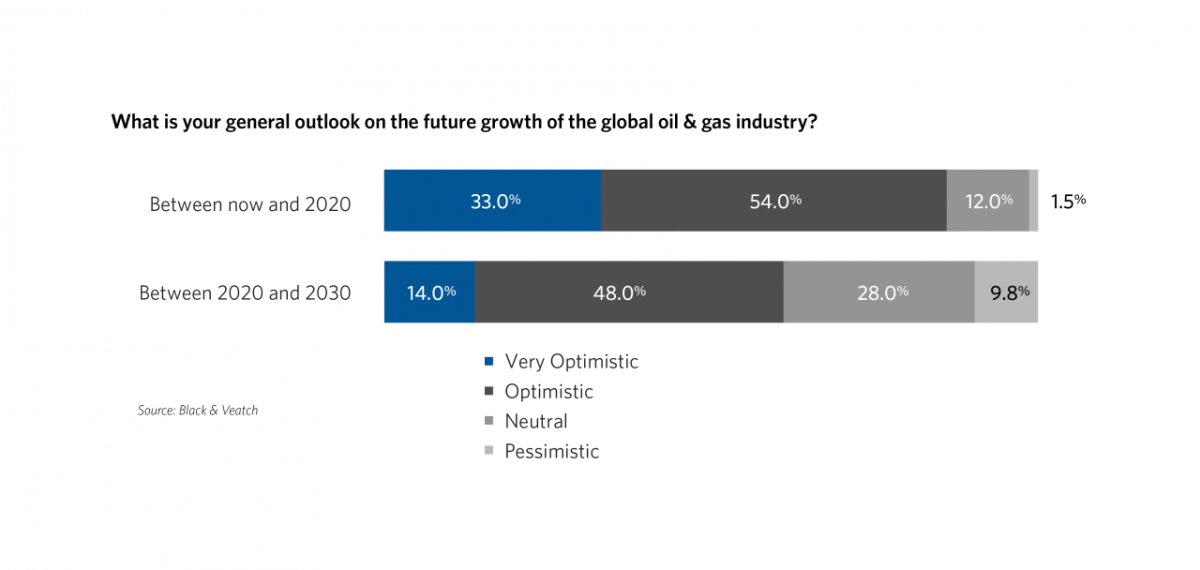

A growing concern among industry players is unmistakable. Respondents to Black & Veatch’s 2019 Strategic Directions: Natural Gas Report survey appear more bullish on the near-term growth potential than the long term. While optimism is dominant in both windows, neutral and pessimistic outlooks arise the further respondents look into the horizon.

Clean energy-driven public policy goals across the world, combined with perceptions of falling renewable and energy storage costs, present a displacement scenario for natural gas. A major factor is government-driven sustainability mandates. Africa, Europe and India have all set aggressive renewable energy targets by 2030. In China, where air quality concerns are driving power generation away from fossil fuel sources, the government is pursuing wider adoption of renewables, although its near-term roadmap relies significantly on LNG imports to create distance from coal.

Within the U.S., the “has-been” argument is strongest in California, which recently passed policies requiring renewables to account for 60 percent of power generation by 2026, and 100 percent by 2045. Renewable sources already served 50 percent of California’s total electric load in 2017, and in some scenarios, solar photovoltaic (PV) has already begun displacing midday natural gas generation.

Meanwhile, there is a sustained trend of declining renewables and storage costs. According to Bloomberg New Energy Finance, global solar capacity is expected to reach 740 gigawatts by 2022, with nearly half of installed capacity and a third of electric generation coming from wind and solar sources by 2040. Energy storage, the key to fully harnessing intermittent power generation, will continue to gain momentum and catalyze the growth of renewables.

Natural gas, however, is anything but diminished on the global stage. Key factors will both keep natural gas as a global energy centerpiece for the foreseeable future but also shift the market and stoke lingering questions about long-term investment (Figure 3).

Demand in Emerging Markets: The IEA forecasted in its Southeast Asia Energy Outlook 2017 that demand for natural gas will grow by 60 percent by 2040, due to rising consumption in power generation and industry. One estimate holds that by 2035, more than half of the region’s gas demand will be met by LNG. Demand growth for natural gas from India and China, despite each country’s renewable energy targets, reflects an “all of the above” approach to meeting energy demand that should keep natural gas in the discussion far longer than many anticipate.

LNG Infrastructure is Heating Up: With abundant supply from major sources such as the United States and the Middle East and rising import appetites elsewhere, LNG’s future is robust. LNG production and shipping technologies, particularly FLNG, are maturing and more quickly moving supply to demand- heavy markets, which should prompt more players — and regional consumers — to step up. More than ever before, today’s technological advancements offer the ability to monetize stranded gas resources and to serve isolated demand pockets.

Trade Dispute: In late 2018, the specter of an all-out trade war was looming large over the global gas market, particularly for LNG. China responded to U.S. tariffs on $200 billion worth of Chinese goods by targeting $60 billion in U.S. exports, including a 10 percent tariff on U.S. LNG. It didn’t take long for the moves to change the global conversation around LNG shipments. Citing difficulties in arranging Chinese customers because of the trade dispute, Australia-based LNG Ltd said it was delaying a final decision on whether to build its U.S.-based Magnolia LNG plant in Louisiana.

Tariffs on U.S.-produced LNG would raise the cost of transporting natural gas to Chinese customers, dramatically changing the fortunes of U.S. producers counting on Asian demand. The dispute also challenges the natural gas investment market, as tariffs stood to jeopardize proposed gasification facilities and open the door for competitors in other regions to fill the gaps.

Ramping Up Renewables: Momentum for renewables remains tempered by the scalability challenges when higher penetration is targeted. Energy storage has yet to fully resolve seasonality and intermittency issues, and, despite falling costs, financial investments required for large-scale deployments aren’t trivial. More broadly, uncertainty persists about how quickly electrification can be achieved. Despite California’s accelerated renewables roadmap, the question is especially relevant given that power generation (which is targeted by the 100-percent renewables mandate included in the recent state law) only accounts for one-third of California’s natural gas use with residential, commercial and industrial uses accounting for the remaining two-thirds of natural gas consumption. The state’s switchover is expected to be complex, time-consuming and potentially expensive.

Building a Bridge

It is believed that a significant component of the world’s energy demand will, over the long term, depend highly on natural gas in roles ranging from primary to complementary. In Europe, for instance, BP’s recent Energy Outlook shows natural gas holding and even gaining market share, as gas and renewables are each projected to contribute a share equal to oil in the energy mix.

Economic development and industrialization within the emerging economies of Asia and Africa are creating a thirst for energy. Demand in China, India and other Asian countries that are not members of the Organisation for Economic Co-operation and Development (OECD) account for two-thirds of this growth in energy consumption, drawing strongly upon natural gas.

The link between gas and renewables can be stronger than mere siloed parts of a diverse power portfolio. For example, new scenarios are emerging that pair storage with conventional gas turbine generation to deliver more rapid response, milder ramp rates, fewer starts and stops, and emissions reductions. Battery storage-augmented gas turbines are being explored by some American utilities.

With reliability and responsiveness driving investment, cost-effective natural gas assets will continue to have a place in meeting global energy needs — especially in emerging markets where energy needs are immense and all options are on the table. And in regions where renewables are maturing, their increasing penetration still requires an increase in the amount of natural gas- red backup to accommodate the faster up and down ramping requirements of electric generation caused

by distributed energy resources. Additionally, although much of the current discussion is on the use of natural gas for power generation and its interplay with renewables growth, natural gas demand for industrial uses and transportation is also expected to grow significantly.

Global market forces demonstrate that natural gas is neither an absolute solution nor a “has-been.” It’s a major, clean-burning catalyst for reliable energy across the globe, and its expanding role in key markets, both on the import and export sides, confirms that.

---------------------------

Deepa Poduval is a Senior Managing Director, leading the Oil & Gas and Mining practice within Black & Veatch Management Consulting. She has advised various clients on strategic responses to key issues impacting their business including growing gas-electric interdependencies and related implications for participants in both industries, the evolving role of natural gas in the global energy mix, emerging commercial trends in the global LNG market, and implications of sustained low energy prices on project viability, risk and future growth.