Turning Data into Action

Originally published on Black & Veatch website, January 14, 2020

Leveraging smart infrastructure to enable data-driven utility operations has long been a work in progress, and advancement has been uneven. While many utilities have access to vast amounts of data thanks to deployment of advanced metering infrastructure and sensors across new and legacy assets, only a few early adopters have operationalized the data in a significant way.

For example, the New York Power Authority (NYPA), the largest state public power utility in the U.S., is actively working to transform itself into a true “digital utility.” The utility is “one of the key creators and implementers” of Gov. Andrew Cuomo’s Reforming the Energy Vision (REV) initiative, which aims to transform how electricity is produced, bought and sold in New York state. Recognizing the need to gain comprehensive insight into the systems within their jurisdiction, the NYPA has invested in creating digital twins of all their assets, deploying technology capable of modeling how their systems might react to major storms, cyberattacks and other risks.

Similar to the NYPA, a growing number of large investor-owned utilities are making major commitments to using data to truly transform their operations. These utilities are enabled by the availability of software as a service and cloud-based solutions from third-party vendors, making it easier to close the digital divide. Even so, more than half of utilities said budget constraints, followed by competing priorities and regulatory hurdles, are impeding their ability to have smart distribution infrastructure that gathers data from sensors that can be used for a range of decision-making activities.

Artificial Intelligence and Analytics

Given these constraints, the use of data for asset management has seen perhaps the greatest amount of interest, given that the ability to anticipate equipment failures and avoid costly outages presents a straightforward case for regulatory approval. This is particularly important for gas utilities, which are under greater scrutiny over risk-management practices after a series of highprofile safety incidents in recent years. The emergence of tools enabled by artificial intelligence (AI) to provide predictive analytics is especially important for all utility sectors, as the aging assets most likely to fail are less likely to be equipped with sensors. Better system intelligence and analytics also facilitate better and more reliable operation of utility systems and facilities.

Beyond enhancing reliability, early movers also seek to leverage data analytics and AI capabilities to build resilience. Many of these early movers have been collecting terabytes of data yet doing little with it so far. Data-driven modeling is a key for power utilities to anticipate and control the behavior of distributed energy resources (DER), improve distribution grid resilience and enable more granular pricing. Sophisticated data analytics also are key to making the regulatory case for sustainable investments that take into consideration the benefits for the utility, the customer and the environment.

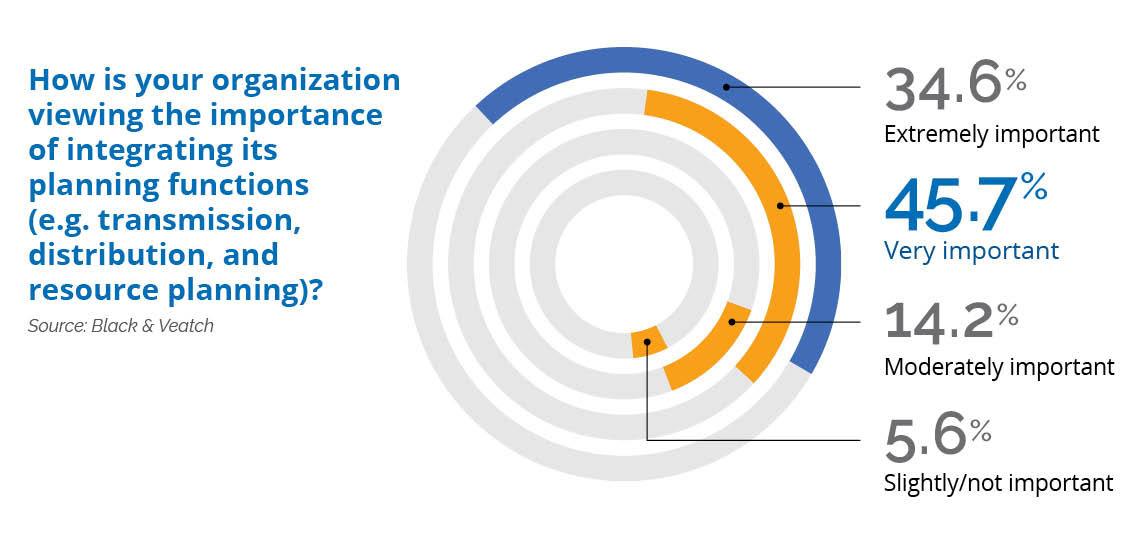

To this point, the data-driven integration of utility planning is emerging as a fast-growing use case, with 80 percent of respondents ranking planning integration as “very” or “extremely” important (Figure 10). For water utilities, digital tools are being used to dynamically plan and prioritize capital improvement plans based on scenarios of severe storms, financial events and more. Similarly, more than three-quarters of power utilities either “somewhat” or “strongly” agree that integrated IT/OT planning will deliver significant benefits.

Opportunities, Challenges of Digitization

The pandemic has proven data and IT solutions are valuable for operations planning, work prioritization and personnel management. Digitization has helped facilitate rapid changes to asset maintenance and incident response protocols, including a move to one-person crews, different work-staging processes and even quarantining on-site staff at critical facilities. As in other areas of the economy, it also has made it possible for large swaths of utility personnel to work remotely. While some of these changes may be temporary, the cost savings and efficiency improvements are likely to make them permanent in many cases.

Because data analytics is becoming core to utility operations, it has heightened the challenges they face in replacing an aging workforce. Eight out of 10 utilities see digital savviness as “somewhat more” or “much more” important for new hires today than it was five years ago (Figure 12). But that means utilities are competing with the likes of Amazon and Google, as well as the financial sector, for the latest crop of data scientists that may not see the utility sector as cutting edge.