AB: Are Carbon Offsets the Next ESG Investing Frontier?

By Sara Rosner| Director, Environmental Research and Engagement—Responsible Investment and Satyajit Bose| Associate Director—Program in Sustainability Management at Columbia University

Carbon offsets occupy a relatively small space on the spectrum of environmental, social and governance (ESG) issues. But as more countries and companies commit to net-zero carbon emissions goals, they’re steadily gaining attention from investors as a tool to accelerate carbon reductions. Growing demand has fueled record-high prices in some markets.

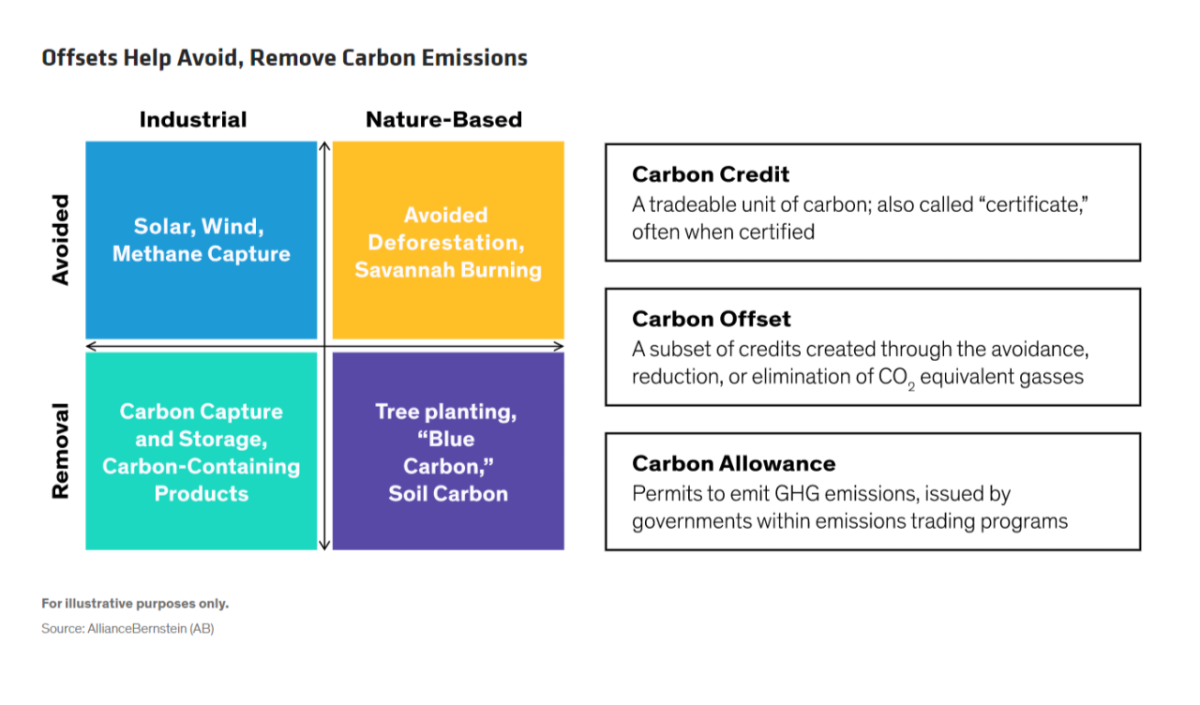

Companies have relied on offsets to help avoid or reduce emissions for decades. Long associated with the “cap and trade” (compliance) market, they’re traded globally in two ways: as allowances among companies to comply with mandatory emissions caps or as part of various abatement initiatives in the voluntary markets. Offsets are generated through carbon-reduction activities across two broad categories: industrial and nature-based. Solar and wind power, for instance, are examples of industrial initiatives to avoid carbon emissions while tree planting is a nature-based carbon removal initiative (Display).

Currently, 68 compliance markets span the globe, representing about 23% of total greenhouse gas (GHG) emissions. Strong demand now outweighs supply, and prices in some markets have reached new highs. About US$84 billion was collected in global carbon pricing revenue in 2021, compared to US$53 billion the year before. Rapid growth is expected especially in the volunteer market, where companies purchase credits from carbon reduction initiatives that are not necessarily linked to regulatory regimes. In fact, volunteer market offset activity hit US$1 trillion for the first time in 2021, according to the World Bank.

Market Parameters and Rules Are Starting to Gel

Offsets are still evolving as a distinct asset class. The markets are starting to take better shape as regulators and other groups help codify some rules around them.

Pending guidance from the Institutional Investors Group on Climate Change, for example, articulates company engagement and capital allocation best practices. The recent COP26 global climate change conference adjourned with a first-ever multinational agreement for trading standards. They included clearer rules to facilitate arbitrage across developed and emerging-market jurisdictions, which is considered vital to improved legitimacy and global uptake.

In the US, proposed SEC disclosure rules around climate change impacts would mandate offsets reporting in annual statements—a big step toward greater transparency and accountability. The move has sparked such a swarm of interest and debate that the SEC issued a rare extension of the window period for comments.

Investors More Aware of Offsets Role in ESG

Investor interest in offsets is steadily growing too, as the emphasis on corporate commitments to address climate change intensifies and more solutions are placed on the table. Shareholder activism around ESG is expected to soar in the coming years, with considerable pressure on the “E” factor. In this vein, more investors are keenly aware of how offsets can directly impact a company’s cash flow, reputation and legal standing, among other variables (Display). So, when the Carbon Disclosure Project (CDP) reports that just 100 companies are responsible for 71% of world GHG emissions, shareholders are highly motivated to advocate for effective counter measures. We now expect these exchanges on carbon offsets to increasingly feature in proxy votes.

Quality Control Still Has Gaps

New guidelines and growing investor awareness are helping carbon offsets gain traction. But we think it’s important to focus on both quality and quantity. Some offsets are verified by a regulatory body or government-sanctioned certifier, such as the Australian Carbon Farming Initiative or the California Air Resources Board. Other offsets are verified by nonprofit certifiers such as the Gold Standard, Verra, the American Carbon Registry or the Climate Action Reserve.

But for offsets to enter the mainstream, investors will need much more guidance. For instance, can they gauge whether an offset will contribute to real carbon reductions? Or does it just level set a company’s growing emissions output? The world produced a record 37 billion tonnes of CO2 in 2021, the highest in the 64 years it’s been recorded by Hawaii’s Mauna Loa Observatory. Clearly, investors of all types who wish to make an impact using carbon offsets will need reliable yardsticks to determine if they’re solving the problem or not.

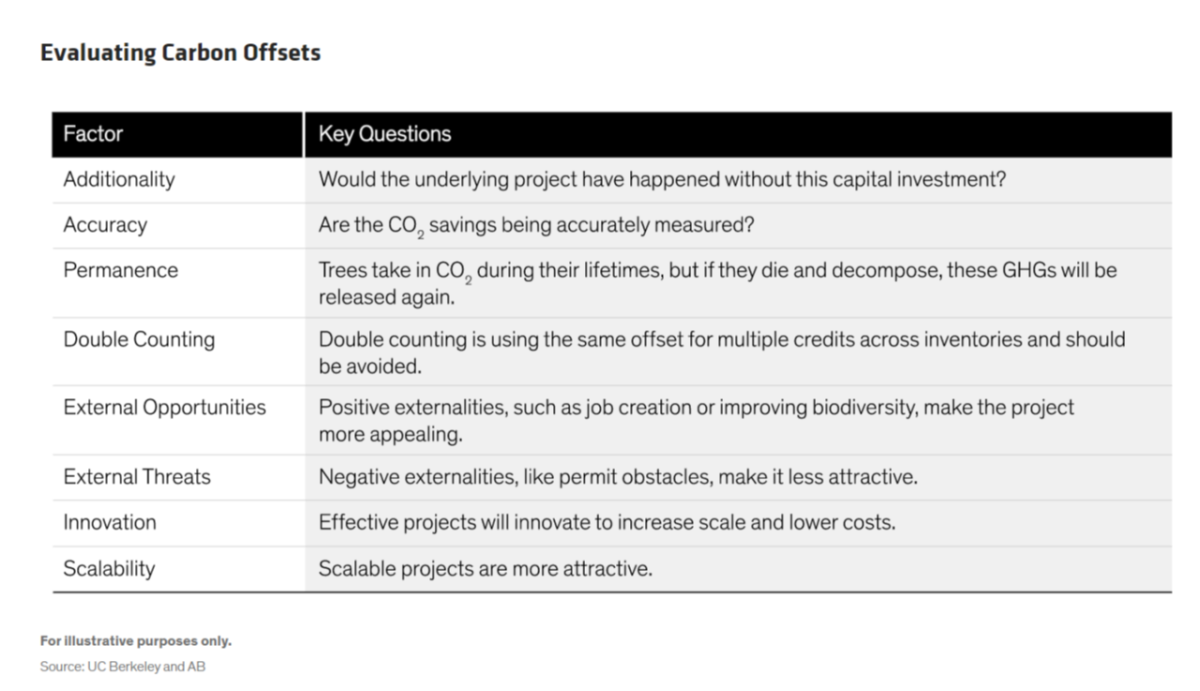

In addition, it is important for investors to assess the stakeholder impact of offsets. Carbon reduction activities with local co-benefits (job creation, biodiversity preservation) are likely to be well embraced by local stakeholders. This can lead to greater permanence and legitimacy and help minimize external threats. While such projects may cost more, they might carry less risk.

Some of the new metrics criteria look promising. A handful of ESG data providers are incorporating carbon prices in different temperature scenarios to gauge a company’s transition to net zero. Academia is on board too. This includes the Columbia Climate School, which partners with AllianceBernstein to educate investors and managers on carbon offsets and other climate-related issues. UC Berkeley’s CoolClimate Network shares its comprehensive quality assessment framework (Display). Among the rubric’s red flags is double counting, a common occurrence because of unclear accounting rules. For example, buyers could credit the same offset in different areas of its emissions inventories, or the same credit could be counted multiple times across jurisdictions. But a planned move toward more uniform global administration—another COP26 takeaway—should prevent this.

It will take time before carbon offsets become asset allocation options for the average investor. But better transparency, pricing and other market standards have given them some well-deserved spotlight. We believe they’re worth actively exploring within a broader ESG-investing context. Their global abundance can especially encourage flows of capital to stakeholders in developing countries and help facilitate broader attainment of SDGs. When implemented correctly, offsets play an important supporting role in the fight against global warming, especially when reducing carbon emissions is a battle of increments, not an overnight fix.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time.

About the AuthorsSara Rosner is the Director of Environmental Research and Engagement on the Responsible Investment team. She co-chairs the firm's ESG Research, Training and Thought Leadership Group and manages AB's collaboration with Columbia University's Earth Institute, which focuses on enhancing investors' ability to integrate climate change considerations into their decision-making and investment processes. Prior to joining the firm in 2018, Rosner performed research for the Columbia Center on Sustainable Investment, where she worked on projects related to the United Nations Sustainable Development Goals and renewable energy alternatives in the extractive industry. She spent most of her early career as a journalist covering energy and infrastructure finance in the Americas for Euromoney Institutional Investor. Rosner is a global member of 100 Women in Finance and a financial literacy volunteer with the High Water Women Foundation. She holds a BS in international studies, magna cum laude, from Pepperdine University and an MS in sustainability management from Columbia University. Location: New York

Satyajit Bose is Associate Director of the Program in Sustainability Management at Columbia University, where he teaches sustainable investing, cost-benefit analysis and mathematics. His research interests include the value of ESG information, carbon pricing, the link between portfolio investment and sustainable development in emerging markets, and the optimal use of environmental performance metrics for long-term investment choices. Bose is co-author of The Financial Ecosystem: The Role of Finance in Achieving Sustainability.

View original content here.