How to Accelerate Bending the Temperature Change Curve

How to Accelerate Bending the Temperature Change Curve

by Pooja Khosla, Ph.D. of Entelligent

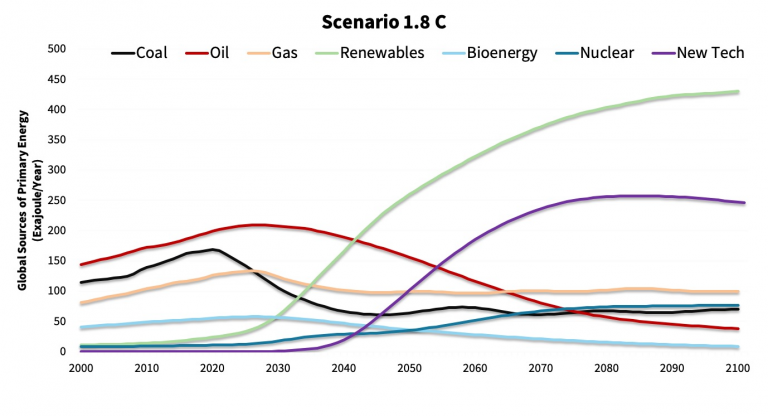

With increased capital investments in the renewable sector and higher representation of renewables in the electric sector, the path to a low-carbon future has become more desirable but uncertain as well. World leaders are now faced with a choice: Reopen economies powered by the failing fuel sources of the past, or jump-start paths toward a clean, secure and prosperous future by investing now for the long term. The bigger question is whether the expansion of renewables is sufficient to achieve the recommended 1.5°C target temperature while meeting industrial and commerical demands?

Advancing energy efficiency and direct desired policy shocks such as high subsidies to renewables and a carbon tax will trigger huge shifts in corporate balance-sheets. If there is global desire to bend the temperate curve to the 1.5°C target, financial stakeholders such as banks, asset managers, institutional investors, pension funds and portfolio managers must take action and integrate knowledge and information on climate transition risk with their investment strategies. The policy, supply chain and energy mix disruption shocks that we are experiencing related to COVID-19 are classified the same as climate change — as an unpredictable unknown. Accelerating change and bending the temperature change curve demands that we immediately account for such shocks by accounting for climate change risk.

Read about all of this and more as well as see an array of graphs on different future scenarios, all here - https://greenmoney.com/how-to-accelerate-bending-the-temperature-change-curve

========