KKR 2021 Sustainability Report: Climate

Globally, there is an urgent need to take climate action and address related risks and opportunities as we transition to a lower carbon economy. The physical and transition effects of climate change can influence a business’ bottom line and its ability to compete in the future. We believe that proactively engaging on climate action is critical for all companies to drive performance and compete in their markets.

OUR APPROACH

Our Climate Action Strategy is the latest chapter in KKR’s long history of working with portfolio companies to understand and manage their environmental performance. We see climate as a global challenge that requires solutions at all levels, and we are thinking about how we invest, where we invest, and what we do to drive value creation.

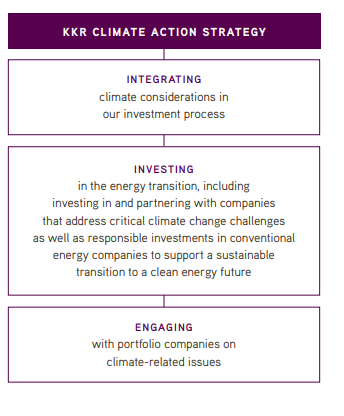

KKR CLIMATE ACTION STRATEGY

- INTEGRATING climate considerations in our investment process

- INVESTING in the energy transition, including investing in and partnering with companies that address critical climate change challenges as well as responsible investments in conventional energy companies to support a sustainable transition to a clean energy future

- ENGAGING with portfolio companies on climate-related issues

SCALING UP: 2021 HIGHLIGHTS

- Estimated Scope 1 and 2 GHG emissions footprints for a number of funds representing more than 50 portfolio companies

- Set net-zero by 2050 goals at three private markets funds that are currently being raised

- 1st Climate Action Report published, in line with TCFD recommendations

- 4th webinar presented, focusing on what carbon offsets can – and can’t – do as part of our Climate Action webinar series

Our engagement with portfolio companies on climaterelated topics dates to 2008 when our Green Portfolio Program Fund (now known as the KKR Green Solutions Platform) was launched in collaboration with the Environmental Defense Fund to support operational improvements, including energy efficiency and GHG emissions reductions that also drove business benefits. The KKR Eco-Innovation Award, launched in 2016, catalyzed and recognized portfolio company projects that provide innovative, environmentally beneficial solutions while creating business value. More recently, we conducted a four-part Climate Action webinar series with related resources to build capacity and spur action. While these and other programs have evolved, our ongoing commitment to engage with companies on climate-related risks and opportunities remains the same.

Today, we have dedicated team members working with companies on climate action. We regularly leverage our operational experts such as KKR Capstone and our Sustainable Investing subject-matter experts to help our portfolio companies develop, shape, and enhance their climate-focused strategies. These resources can also include third-party technical experts such as ERM, the largest global pure-play sustainability consultancy, in which KKR invested in May 2021 through our Core Private Equity strategy.

While three of our new funds have set net-zero by 2050 goals, we are working across the portfolio to support companies' decarbonization efforts, which include developing guidance for our teams and portfolio companies on each step of this work, including carbon footprinting.

INVESTING IN A SUSTAINABLE ENERGY TRANSITION

KKR is working to be a responsible part of the solution to climate change by supporting a sustainable energy transition to a clean energy future. We also recognize that technological and commercial realities mean conventional energy resources will remain important even under aggressive carbon reduction scenarios.

Thus, we invest in a diverse range of energy sources, including renewable energy, such as wind and solar power generation, as well as conventional energy. We do not invest in new fossil fuel energy exploration and, where we do invest in fossil fuel energy through our Energy Real Assets business and Infrastructure business, we emphasize progress toward a stable energy transition and improved ESG practices.

We believe that by being a responsible operator through the transition, we can produce better outcomes than if we exited the space and sold our assets – and therefore transfer emissions – to other operators who may not share our commitment to responsible stewardship.

In 2021, KKR’s Infrastructure team made a number of investments behind this theme globally, including recent investments in or partnerships with Caruna, Finland’s largest electricity distribution company, and Sol Systems (see case study at right). Additionally, KKR's Global Impact strategy invests in businesses delivering solutions to critical global challenges, including climate action and sustainable living.

BY THE NUMBERS

- $25+ bn1 total equity committed to climate and environmental sustainability2 investments including $14+ bn1 committed into renewable assets, such as solar and wind, with total capacity over 26 GW

- 8th largest owner of solar assets in operation and under construction in the United States3

SCALING UP: OUR 2022 PRIORITIES

In line with our Global Ambitions, we seek to support and collaborate with companies to improve performance on these topics. We aim to:

- Integrate climate-related risks and opportunities into investment decision-making and management practices

- Report on certain of our assets’ climate-related activities to fund investors annually, including seeking to provide information on Scope 1 and 2 emissions and certain Scope 3 emissions data, and describing the steps taken by portfolio companies in developing and implementing decarbonization plans, where relevant and available

- Where we are a minority investor, implementing a stewardship and engagement strategy consistent with our Global Ambitions

Read the full 2021 Sustainability Report.

1 As of December 31, 2021. Includes investments by KKR and Global Atlantic (KKR subsidiary).

2 Climate-focused sectors include: renewable energy, energy efficiency, emissions reductions, climate services; environmental sustainability-focused sectors include: pollution, waste, water, circular economy, land adaptation, transportation. For more detail on calculation methodologies, refer to the Endnotes of this report.

3 Bloomberg New Energy Finance, as of March 2022