Brands Taking Stands™ | New Cause-Driven Strategies Upend Food and Beverage Industry

Brands Taking Stands™ Newsletter | August 21, 2018

THE BIG STORY

PepsiCo’s purchase of SodaStream for $3.2 billion is the latest example of how cause-driven changes in taste and attitudes are disrupting the food and beverage sector. Consumers, especially millennials, are choosing smaller, newer food and drink brands marketed as more natural, healthier, and/or more local over traditional, bigger brands. These disruptor companies also tend to include eco-friendly factors— such as their environmental footprint and sustainable supply chains — in their practices and missions.

Legacy companies have noticed. “The big things are declining. The smaller things are growing,” Anheuser-Busch InBev CEO Carlos Brito has told investors. The response from global food and beverage companies has been to acquire healthier brands to reposition their offerings as more health conscious, often complete with environmental side benefits. These brands tend to be newer companies with innovative products that locked-in on the cause-related consumer attitudes prevalent in today’s marketplace.

SodaStream — ironically, a venerable brand with a soda water history that tracks back to 1903 when it was founded in Britain — was re-positioned as a healthier choice after being acquired by an Israeli company in 1996; it took off around 2010. Its purchase by PepsiCo comes with another cause-related bonus: A way to address the issue of proliferating single-use plastic bottles that have clogged landfills and littered landscapes. SodaStream CEO Daniel Birnbaum told Fortune that his company plays into the current “mega-trend” of consumers looking for ways to reduce their carbon footprint. The SodaStream machine adds carbon dioxide to reusable bottles that consumers fill with tap water.

PepsiCo notes that the acquisition fits well with its Performance with Purpose initiative, which focuses on health and wellness through environmentally friendly and cost-effective beverage offerings.

The company has previously acquired small, more nutritious brands like Sabra, which produces hummus and other Mediterranean foods, Kevitakombucha, and Naked juice. It has also developed recipes that are lower in salt and fat, and has experimented with non-sugar sweeteners. Last week, the company announced the creation of a new division, The Hive, to focus on developing new, emerging brands. The unit will focus on smaller brands that already exist within the company, and also create new ones that trade on contemporary trends. CEO Indra Nooyi called The Hive “a small, entrepreneurial sort of agile group.” Pepsi’s plans call for sales growth of its healthier products to outgrow traditional snacks by 2025.

PepsiCo’s shift is a major effort at re-tooling a global multi-national corporation while it’s still operating in its traditional mode—and within a hyper-competitive retail sector. It’s a bit like doing open heart surgery on someone walking down the street. But considering the rapidly changing landscape in the food and beverage industry, PepsiCo and its competitors really have no choice - and in this case, the acquisition of SodaStream should prove to be a nimble decision.

This strategic re-set is taking place throughout the industry, with “healthier” and “eco-friendly”—preferably both—as guiding goals. Coca-Cola has bought a minority stake in BodyArmor, a sports drink backed by basketball star Kobe Bryant, to challenge Pepsi’s Gatorade, which has 75% of the current market. “BodyArmor’s products use coconut water, have higher levels of potassium than its competitors and do not use artificial colors, and the company has marketed its products as healthier alternatives to Gatorade and Powerade,” reports Financial Times.

Anheuser-Busch InBev is launching a new accelerator to support start-ups working on solving climate challenges, reports BusinessGreen. The 100+ Accelerator will see the world’s biggest brewer invest up to $100,000 per company to deliver “breakthrough advancements” in areas such as green logistics, water scarcity, responsible sources and product upcycling. The program is set to run every year, as part of the firm’s pledge to solve 100 climate and environmental challenges by 2025.

Similar changes are in action on the food side. The Kraft Heinz Company has committed to ensuring all its packaging is recyclable, reusable, or compostable by 2025 as it strives to become more circular reports edie.net. The company will “aggressively pursue” innovative alternatives to virgin plastics, which comes after it pledged to make its iconic Heinz Tomato Ketchup bottles “fully circular” by 2022. Kraft Heinz has also announced that it is on track to set an approved science-based target in the next two years. Kraft Heinz’ chief executive, Bernardo Hees, said. “Even though we don’t yet have all the answers, we owe it to current and future generations who call this planet home to find better packaging solutions and actively progress efforts to improve recycling rates.” And Tyson Food, known for its chicken, is moving to animal-free “meat” to become a “protein” vending company. It has invested in Future Meat Technologies, an Israeli startup developing “cultured meats” from cells in petri dishes. Tyson has also invested in Memphis Meats, a San Francisco company that is developing lab-grown beef, poultry and fish, and in Beyond Meat, the leading brand in plant-based protein products nationwide, reports Bloomberg. It has also appointed its first chief sustainability officer.

How these brands taking stands on nutritionally healthier and environmentally responsible strategies will earn out will be a much-watched scenario by all players in the food and beverage industry. Other sectors where traditional practices and strategies are being challenged by cause-driven factors — finance, transportation, energy — are also looking to these examples for lessons to be learned.

NEWS YOU CAN USE

Taking the Long View Promoted by Business Roundtable—and the White House

In June, JPMorgan Chase CEO Jamie Dimon and Berkshire Hathaway CEO Warren Buffett issued a call for a change in the traditional practice of quarterly reporting of earnings-per-share by publicly traded companies. In a WSJ op-ed, they argued that the four-times-a-year check-ins, mandated by the Securities and Exchange Commission to encourage transparency, and therefore confidence, among investors have instead created a too-strong focus on propping up short-term share price in place of strategic, long-range planning. “Together with Business Roundtable, an association of nearly 200 chief executive officers from major U.S. companies, we are encouraging all public companies to consider moving away from providing quarterly earnings-per-share guidance.”

Their bottom line is that short-termism is actually harming the economy. (The globally active executives may have been prompted by the example of the European Union, which abolished requirements that publicly listed companies file quarterly reports in 2013.) Now President Trump has asked the SEC to study whether moving the reporting needle to twice yearly for American corporations would allow cost savings and greater flexibility in long-term planning. Let the debates begin — and they have, both pro and con, throughout the financial industry. One intriguing outlier position is that of Bloomberg Opinion columnist Barry Ritholtz, who calls for dailyreporting of profits on the novel theory that “more frequent reporting makes the data less significant.”

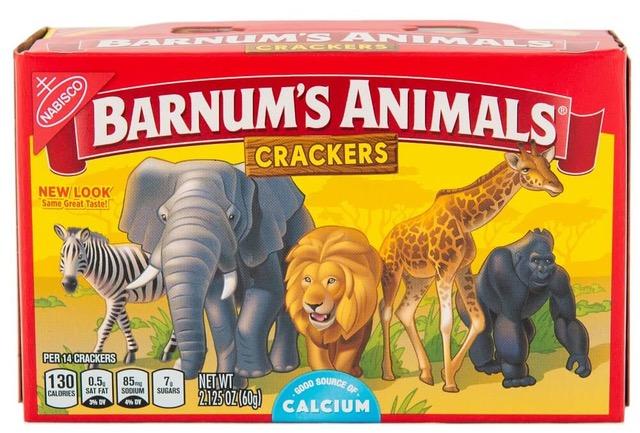

Nabisco Frees “Barnum’s Animals” from Circus Cages After PETA Pressure

Since 1902, the Barnum's Animals Crackers made by Nabisco have been a much beloved snack. In all that time, the animals on its iconic box have been shown pictured behind the bars of a circus boxcar. Now, after concerns raised by the People for the Ethical Treatment of Animals, Mondelēz International, the parent company of Nabisco, has updated the box to show an African menagerie — lion, zebra, elephant, giraffe, and gorilla — roaming loose on open grassland. PETA, which has protested against the use of animals in circuses, wrote to Mondelēz, asking for a new design that showed freed animals. "When PETA reached out about Barnum's, we saw this as another great opportunity to continue to keep this brand modern and contemporary," said Jason Levine, Mondelēz's chief marketing officer for North America. The company is based in Illinois, which passed a statewide ban on circuses with elephants earlier this year. More than 80 U.S. cities have fully or partially banned circuses with wild animals, according to Animal Defenders International. The boxes have been redesigned before, for special editions, reports CBS News. In 1995, Nabisco offered an endangered species collection that raised money for the World Wildlife Fund, reports CBS News. In 1997, it offered a zoo collection to raise money for the American Zoo and Aquarium Association. And in 2010, it worked with designer Lilly Pulitzer on a pastel-colored box that raised money for tiger conservation.

Culture vs. Strategy: The Ongoing Debate

Since business began to be studied, a chicken-or-egg academic game has been to define whether a company’s strategy or its culture is the principal source of competitive advantage. Heidrick & Struggles, a worldwide executive search firm specializing in chief executive and senior level assignments, has weighed in with an answer by asking 11,000 executives for an opinion. Their definitive answer: Executives in higher positions voted for culture. Authors Karen West and Elliott Stixrud conclude, “As leaders rise higher they gain a more comprehensive view of the organization’s many moving parts and see culture as the means of aligning all those parts around strategy,”

Request for Your Views on Corporate Activism

3BL Media has partnered with independent research consultancy GlobeScan to conduct our first Brands Taking Stands survey. Help us understand how and when companies are speaking out publicly on the Big Issues of the day, and what we can expect to hear from businesses in the future. Survey findings will be revealed at the 3BL Forum: “Brands Taking Stands – The Long View” in Washington, D.C. on October 23-25.

Five tickets to the Brands Taking Stands Forum will be drawn from people who take part in the research. The survey closes on September 7 after which the drawing will take place.

Click here to take the survey and enter the drawing.

C-SUITE COMMENTS

“Among his many accomplishments as the UN Secretary-General from 1997 to 2006, Kofi Annan was also the founder of the world’s largest corporate sustainability initiative, the United Nations Global Compact.

As the world embarked on the new Millennium, Mr. Annan inspired the world’s top business leaders to join governments in lifting the poorest nations out of poverty by adopting a more responsible and sustainable approach to business.

In creating the UN Global Compact, Mr. Annan asked corporate leaders to publicly commit to Ten Principles based on UN agreements in the areas of human rights, labor, the environment and anti-corruption.

Some 18 years later, the concept of corporate sustainability is firmly established. More than 9,000 of the world’s leading private sector Chief Executives have joined the UN Global Compact and are driving new approaches to help achieve the Sustainable Development Goals.

As a result of Mr. Annan’s vision, the UN Global Compact is attracting new participants on a daily basis and providing corporate executives around the world with the inspiration and tools needed to drive a more sustainable and responsible business culture which can create prosperity while respecting people and the planet.”

—Lise Kingo, CEO & Executive Director, UN Global Compact

Source: 3BL Media

PEOPLE ON THE MOVE

Jeff Winton has been named SVP of public affairs by Alkermes, the Boston-based drug maker that focuses on treatments for central nervous systems disease and addiction treatment. Previously, Winton was SVP and chief communications officer at Astellas. Prior to Astellas, he was head of global communications at Eli Lilly. Earlier in his career, Winton worked in communications at Roche and at pharma companies that were later acquired by Pfizer and Merck, including Schering-Plough and Pharmacia.

Want to receive this newsletter by email? Sign up here.

Continue the important conversations on corporate responsibility long after 3BL Forum with the Brands Taking Stands newsletter. Written by veteran journalist, John Howell, this newsletter is published every Wednesday morning.