Companies Stand Firm on Their Commitments to Significant Stakeholders, Making Progress on Planet and Policies

CECP releases annual report analyzing state of corporate purpose with research, trends, and cases from the ESG landscape

NEW YORK, April 5, 2021 /3BL Media/ — Leading companies are answering the call from their significant stakeholders to play an ever more important role in community prosperity, environmental protection, and equity, according to a new release from Chief Executives from Corporate Purpose© (CECP), Investing in Society. The annual report is the authoritative source to assess the corporate sector’s progress toward being increasingly purpose and stakeholder driven. Investing in Society organizes its insights as a company might in its own scorecard: Priorities, Performance, People, Planet, and Policies (the five “Ps” framework). The analysis found that significant progress is being made in the areas of Planet and Policies, with most companies making progress in those areas.

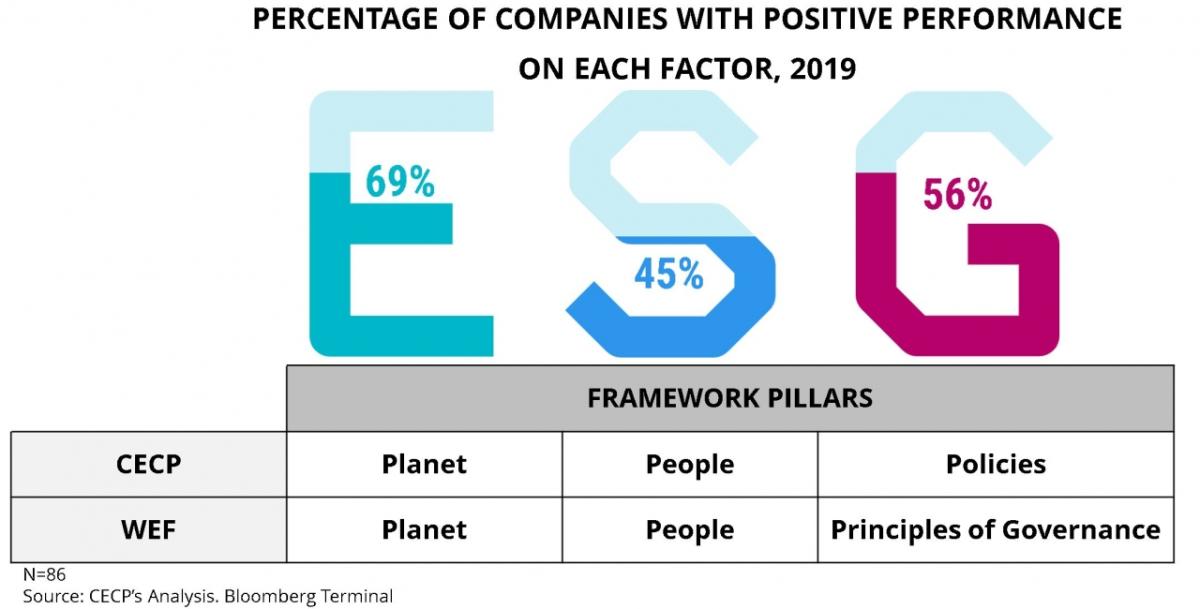

New this year in Investing in Society are CECP’s ESG Factor Analysis and Stakeholder Scorecard. The Factor Analysis explores the degree to which financial and ESG metrics are correlated with each other, while the Stakeholder Scorecard offers a performance snapshot of Fortune 500® companies against ESG and financial performance metrics.

“For corporate leaders seeking data-driven real-world examples of how companies are making progress against their ESG commitments, Investing in Society is a key resource for understanding where they are today, and how to make even more progress over the long term,” said Kari Niedfeldt-Thomas, Managing Director, CECP. “Tracking the state of corporate purpose is vital if business continues to chart a path towards a more equitable future.”

“The inclusion of CECP’s Factor Analysis and Stakeholder Scorecard in this year’s Investing in Society means that corporate purpose is no longer something companies need to estimate,” said André Solórzano, Senior Manager, Data Insights. “With these tools like, companies are more equipped than ever to meet and exceed their ESG goals, making real and tangible progress in finding solutions to some of the world’s most significant challenges.”

Investing in Society highlights include:

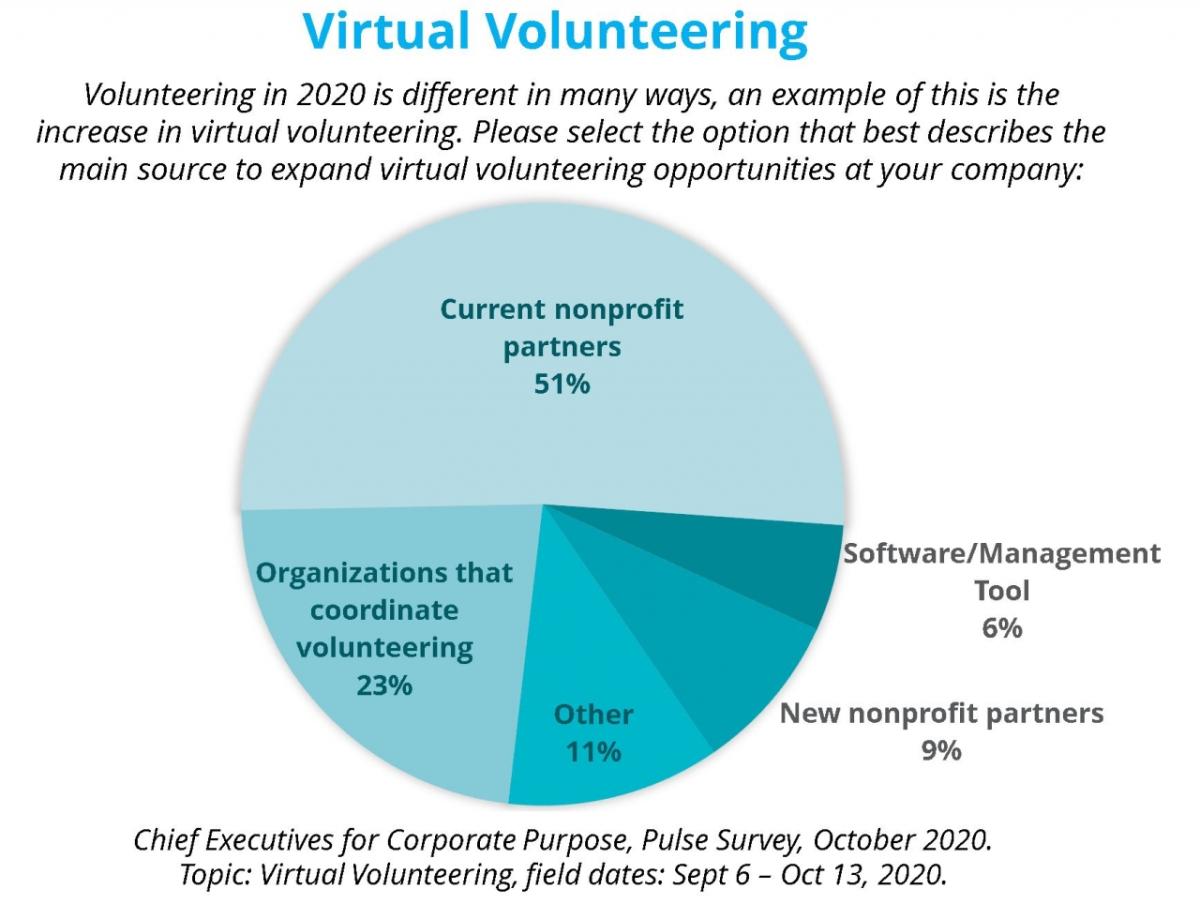

- PRIORITIES: Corporate purpose is helping to define stakeholder capitalism and companies are embracing the potential of purpose through CEO advocacy, bridging divides across opposing groups, updating their purpose statements, rethinking work/life balance, and focusing on the health, well-being, and skills of their employees.

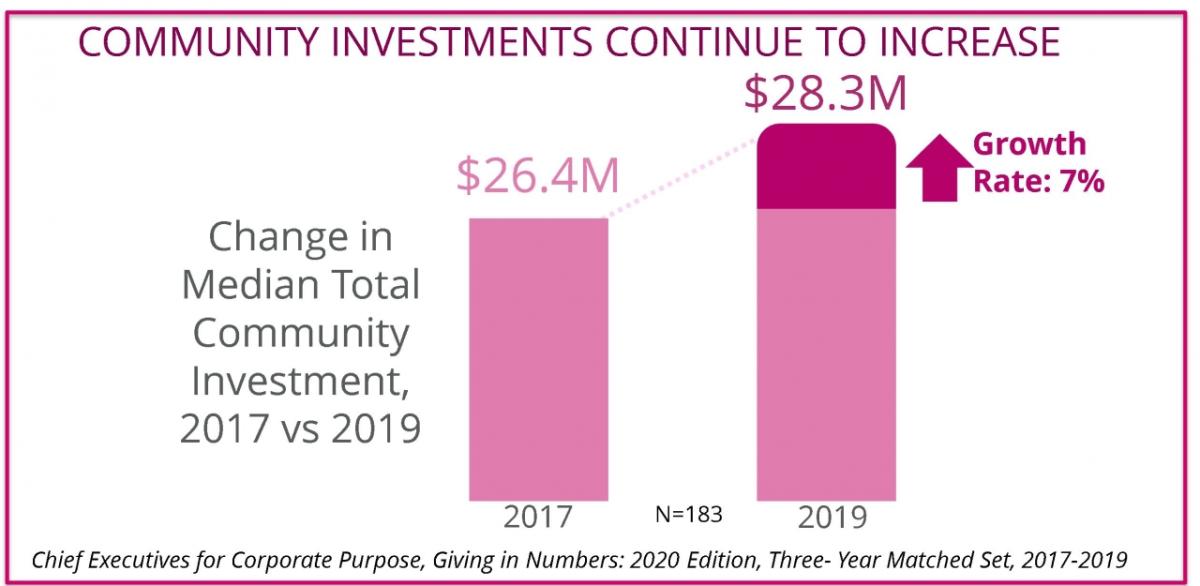

- PERFORMANCE: Companies are increasingly integrating ESG metrics through the business. The interconnection between financial performance and ESG prioritization may be more clearly evidenced in the long-term. The importance of improving financial performance in the corporate sector goes in hand with having a more equitable and prosperous society. Read more about CECP’s metric, Total Social Investment, and how companies are changing business practices to create sustainable value for the significant stakeholders in WEF’s report, Measuring Stakeholder Capitalism.

- PEOPLE: A growing number of companies are taking meaningful steps toward a more equitable workplace. CECP’s Factor Analysis found that 45% of companies showed improvements in diversifying their employees and management teams while another CECP Pulse Survey found that 73% of companies predicted their 2021 DEI budget would increase.

- PLANET: Companies continue to make progress on climate change and other environmental issues, despite a lax regulatory environment over the last four years. CECP’s Factor Analysis found that 69% of companies had a positive impact on the environment by reducing their GHG emissions, total electricity consumption, amount of energy used, and more.

- POLICIES: CECP’s Factor Analysis found that 56% of companies made progress in their efforts to improve compensation transparency and accountability. Companies also improved acting on the idea of integrated corporate governance. The number of companies with a CSR/Sustainability (or related terms) committee on their Board rose 14% between 2017 and 2019.

Investing in Society is the must-read digest for the state of corporate purpose, used by corporate leaders from the world’s largest companies to understand more completely the state of corporate purpose and whether certain areas are improving or worsening. CECP’s assessment combines rigorous analysis with research, trends, and cases from the ESG landscape, examined through the lens of CECP’s engagements with more than 200 of the world’s leading companies. Each section offers compelling and practical examples of business at its best. The 2021 edition of Investing in Society is available for free on cecp.co.

Note to Editors: CECP can coordinate interviews with Kari Niedfeldt-Thomas or André Solórzano who are available for comment on the Investing in Society. Please contact Jackie Albano, jalbano@cecp.co, to arrange interviews.

###

ABOUT CHIEF EXECUTIVES FOR CORPORATE PURPOSE (CECP)

CECP is a CEO-led coalition that believes that a company’s social strategy — how it engages with key stakeholders including employees, communities, investors, and customers —determines company success. Founded in 1999 by actor and philanthropist Paul Newman and other business leaders to create a better world through business, CECP has grown to a movement of more than 200 of the world’s largest companies that represent $11.2 trillion in revenues, $23 billion in societal investment, 14 million employees, and $21 trillion in assets under management. CECP helps companies transform their social strategy by providing customized connections and networking, counsel and support, benchmarking and trends, and awareness building and recognition. For more information, visit http://cecp.co.