Flash Report: 85% of S&P 500 Index® Companies Publish Sustainability Reports in 2017

NEW YORK, March 20, 2018 /3BL Media/ — The Governance & Accountability (G&A) Institute research team has found that eighty-five percent (85%) of the companies in the S&P 500 Index® published sustainability or corporate responsibility reports in 2017.

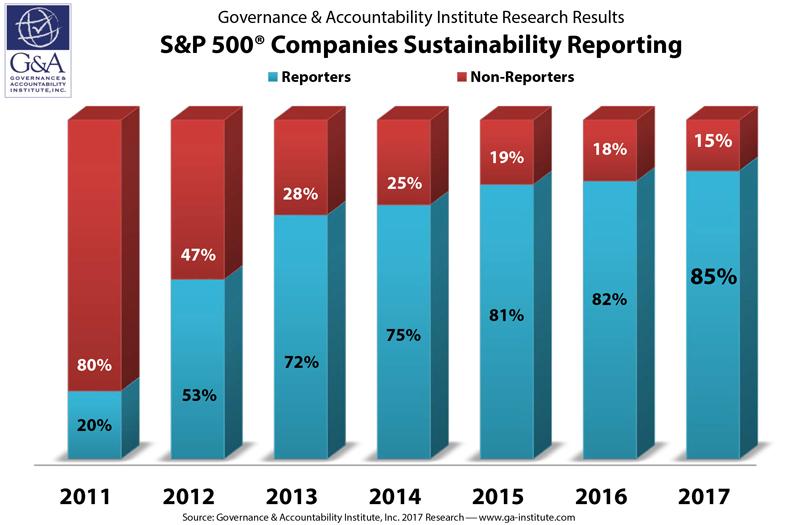

This endeavor marks G&A Institute’s seventh annual monitoring and analysis of sustainability reporting in the S&P 500 Index®, one of the most widely-recognized barometers of the US economy and conditions for large-cap public companies in the capital markets. In charting reporting performance in prior years, G&A researchers found that:

- During the year 2011, just under 20% of S&P 500 companies reported on their sustainability, corporate social responsibility, ESG performance and related topics and issues;

- In 2012, 53% of S&P 500 companies were reporting -- for the first time a majority;

- By 2013, 72% were reporting — that is 7-out-of-10 of all companies in the popular benchmark;

- In 2014, 75% of the S&P 500 were publishing reports;

- In 2015, 81% of the total companies were reporting;

- In 2016, 82% signaled a steady embrace by large-cap companies of sustainability reporting;

- And in 2017, the total rose to 85% of companies reporting on ESG performance.

Entering 2018, just 15% of the S&P 500 declined to publish sustainability reports. The practice of reporting by the 500 companies is holding steady with minor increases year after year. The attached chart represents the trends of S&P 500 sustainability reporting over the last seven years.

COMMENTS

Louis Coppola, EVP & Co-Founder of G&A Institute, who designs and manages the annual analysis, notes: "One of the most powerful driving forces behind the rise in reporting is an increasing demand from all categories of investors for material, relevant, comparable, accurate and actionable ESG disclosure from companies they invest in. Mainstream investors constantly searching for larger returns have come to the conclusion that a company that considers their material Environmental, Social, and Governance opportunities and risks in their long-term strategies will outperform and outcompete those firms that do not. It's just a matter now of following the money."

"The proliferation of ESG data providers, rankers, and raters has also matured alongside the demand from investors, and more disclosure from companies. In addition, globally-accepted reporting standards continue to evolve as the entire field matures and advances, following a similar path to the development of standardized financial disclosure in the first half of the 1900's.

"As someone who has worked on ESG issues their entire professional career, this is personally a very exciting time to be advising leading companies and investors on how to navigate this field. While our study shows there are still holdouts not reporting, the number steadily shrinks each year as an increasing number of stakeholders including customers, employees, investors, local communities, and others demand consideration of ESG in companies’ missions, strategies and operations."

Hank Boerner, Chairman & Co-Founder of the Institute, observed: "We live in a period of conflicting views on critical issues, like the effects of climate change, the societal quest for greater diversity and inclusion, the importance of demonstrating environmental stewardship, the rising expectations for greater accountability of leadership and expectations related to product responsibility.

“It should be very encouraging to all stakeholders that the largest publicly-traded companies in the US clearly recognize their societal responsibilities and strive to develop strategies, fine-tune their programs, engage with their stakeholders, improve their overall ESG performance, and enhance their disclosure by publishing sustainability/responsibility/citizenship reports.

“The actions of the super-majority of the S&P 500 are especially encouraging in the wake of the decision of the current administration to begin the retreat on addressing climate change, reduce environmental protection measures, and ignore other important 21st century measures of national progress. It is clear that the leaders of corporate America are acknowledging the realities of these challenges as they maintain a steady course toward greater corporate sustainability and the protection of the global society.”

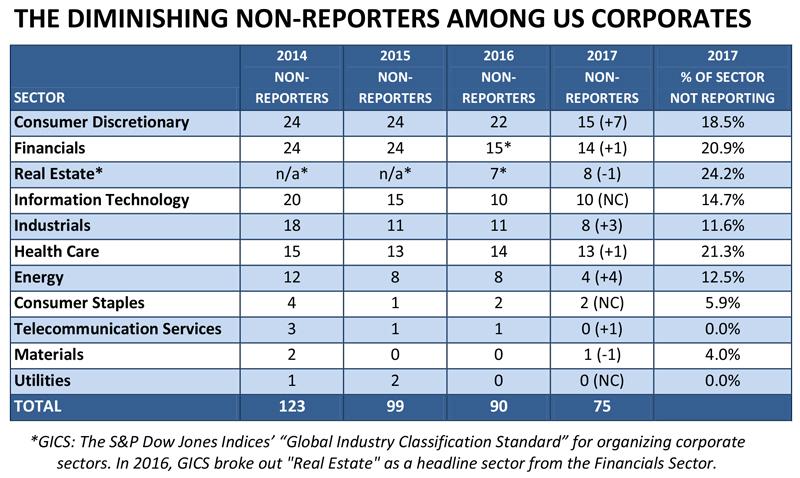

THE DIMINISHING NON-REPORTERS AMONG US CORPORATES

The attached chart presents the number of companies from each GICS* sector that do not publicly report on their sustainability opportunities, risks, strategies, actions, programs, and achievements between 2014 and 2017 -- implying no organized focus on corporate sustainability and ESG performance.

RESEARCH TEAM

Elizabeth Peterson – Team Leader

- Hofstra University – Completing MA, Sustainability Studies (May 2018)

- Pennsylvania State University – BS, Community, Environment & Development

Amanda Hoster

- Duke University, Nicholas School of the Environment – MS, Environmental Management, Business & the Environment

- Kenyon College – BA, Economics, International Studies, Environmental Studies

Matthew Novak

- Louisiana State University – BS, Coastal Environmental Science with Minor in Geography

Yangshengjing “UB” Qiu

- College of William & Mary – BS, Psychology, Environmental Science & Policy

Sara Rosner

- Columbia University – MS, Sustainability Management

- Pepperdine University – BS, International Studies

Shraddha Sawant

- University of Pennsylvania - MS, Environmental Sustainability

- University of Pune, India – BS, Environmental Sciences

Alan Stautz

- University of Michigan – Completing BA, Political Science & Sustainability (May 2018)

Laura Malo Yague

- Columbia University, Earth Institute – MS, Sustainability Management

- New York University – Advanced Diploma, Monitoring & Evaluation (Project Management for the UN, Government & Non-profits)

- Universidad de Zaragoza, Escuela de Ingeniería y Arquitectura – BS Industrial Technical Engineering - Industrial Electronics

Qier “ Cher” Xue

- Duke University, Nicholas School of the Environment – MS, Environmental Management, Energy & Environment

- University of Minnesota, Twin Cities – BS, Environmental Sciences, Policy & Management

For more information on our GRI Data Partner Report Analyst Research Interns, please visit www.ga-institute.com/the-honor-roll.html

ABOUT GOVERNANCE & ACCOUNTABILITY INSTITUTE, INC.

Founded in 2006, G&A Institute, Inc. is a sustainability consulting firm headquartered in New York City, advising corporations and investors on executing winning strategies that maximize return on investment at every step of their sustainability journey. The G&A consulting team helps corporate and investor clients recognize, understand and address sustainability issues to address stakeholder and shareholder concerns.

G&A Institute is the Data Partner for the Global Reporting Initiative (GRI) in the US, UK, and Republic of Ireland. The G&A team performs this pro bono work on behalf of GRI. Over more than seven years, G&A has analyzed more than 6,000 sustainability reports and catalogued hundreds of important data points for these reports.

G&A’s sustainability-focused consulting and advisory services fall into three main pillars: (1) Sustainability/ESG Consulting; (2) Communications and Recognitions, and (3) Investor / Capital Markets Relations. The resources available within each category include sustainability/CSR reporting assistance; materiality assessments; stakeholder engagement; strategy setting; ESG survey responses; ESG benchmarking; investor ESG data review & enhancement; investor relations ESG programs; investor engagement; sustainability communications; manager coaching; team building; training; advice on third-party awards, recognition, and index inclusions; ESG issues monitoring and customized research.

ABOUT THE *S&P 500®

According to the owner, S&P Dow Jones Indices / McGraw Hill Financial: “The S&P 500® is market-value weighted and is widely regarded as the best single gauge of large cap US equities. There is over US$7.8 trillion benchmarked to the index, with index assets comprising approximately US$2.2 trillion of this total. The index includes 500 leading companies with market-cap of $6 billion and more, and captures approximately 80% coverage of available market capitalization.” The S&P 500 is a trademarked® property of S&P Dow Jones Indices, McGraw Hill Financial. Index INDEXCBOE:.INX. Ticker: SPX The Index Annual Return was 21.83% through 12-31-17. The long-term average is 12%. S&P Dow Jones Indices is a division of S&P Global (NYSE:SPGI): www.spdji.com

# # #

G&A CONTACT:

Louis D. Coppola, Executive Vice President & Co-Founder

Governance & Accountability Institute, Inc.

Tel 646.430.8230 ext 14

Email lcoppola@ga-institute.com

www.ga-institute.com