Wells Fargo Invests $442 Million in LIFT Programs, Creating Nearly 20,000 Homeowners Across the U.S.

Homebuyer education, down payment assistance helps with purchase of $2 billion in real estate since 2012

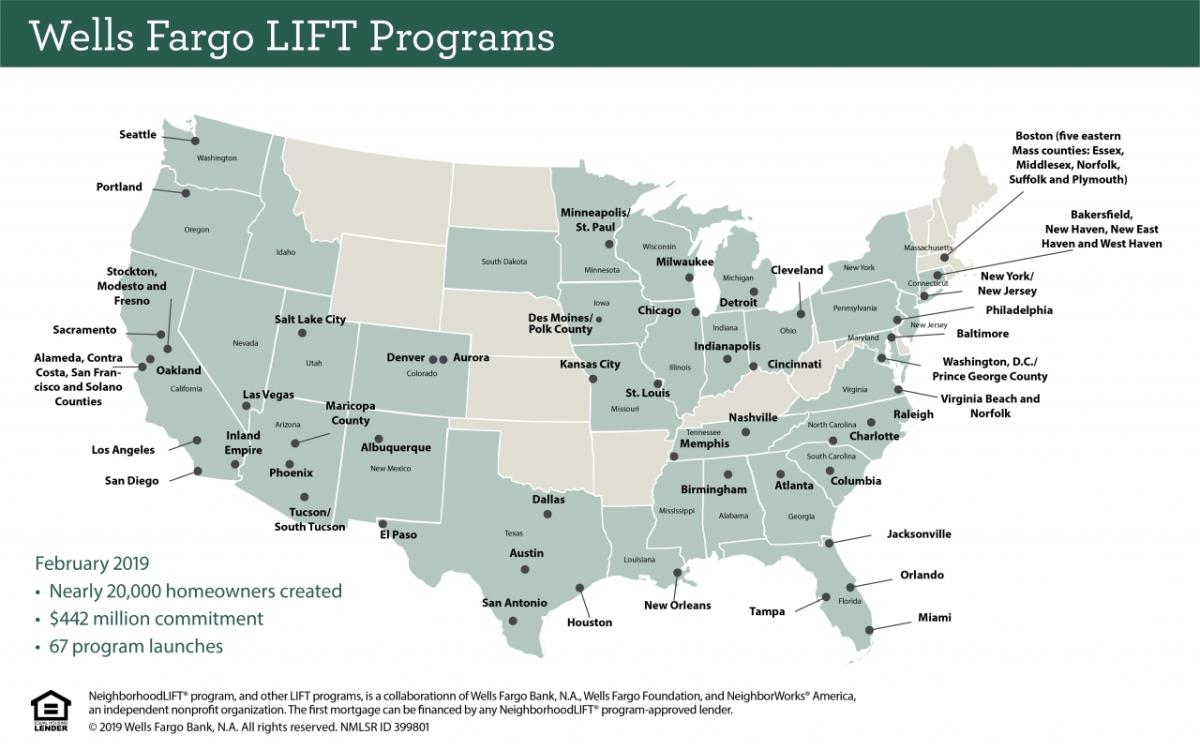

SAN FRANCISCO, February 4, 2019 /3BL Media/– Wells Fargo & Company (NYSE:WFC) and NeighborWorks® America announced today that more than 3,900 homeowners were created in 2018 through the Wells Fargo NeighborhoodLIFT® program — bringing the total number of homeowners assisted to nearly 20,000 since LIFT programs were launched in 2012 in Los Angeles and Atlanta. Wells Fargo has invested more than $442 million for 67 LIFT program launches in support of sustainable housing, making it the single largest corporate philanthropic effort of its kind in the company’s history. NeighborWorks America research indicates that in that time, LIFT homeowners have purchased more than $2 billion in real estate nationally.

NeighborhoodLIFT program offers homebuyer education plus down payment assistance grants in local communities. Today registration opens for the 2019 Washington, D.C., area NeighborhoodLIFT program, scheduled on Feb. 22-23, and the 2019 NeighborhoodLIFT program launch for Los Angeles County drew hundreds of potential homebuyers on Feb. 1-2.

“Owning a home is a primary driver of economic security and the cornerstone of the American Dream, yet access to affordable housing is a significant challenge in communities across the country,” said Wells Fargo CEO and President Tim Sloan. “Wells Fargo is proud to help people achieve and sustain homeownership through programs like NeighborhoodLIFT and in collaboration with organizations such as NeighborWorks America.”

Wells Fargo and NeighborWorks America created the NeighborhoodLIFT program to support local economic development and advance sustainable homeownership. NeighborWorks America and its local network members administer the program, determine eligibility and provide the required homebuyer education. As part of the effort, Wells Fargo also donated $33 million in local initiative grants to nonprofits in support of neighborhood revitalization.

With a $75 million philanthropic commitment by Wells Fargo in 2018, the NeighborhoodLIFT program expanded to Atlanta; New Mexico; Boston; Kansas City, Mo.; Chicago; Des Moines, Iowa; Mississippi; Charlotte, N.C.; and Orlando, Fla. The program also added special parameters to enable hundreds of teachers, military service members, veterans, and first responders to achieve homeownership.

“This collaboration with Wells Fargo, our network members, and local communities helps put people on the path to homeownership,” said Marietta Rodriguez, president and CEO of NeighborWorks America. “The program is helping families meet the challenge of coming up with a sufficient down payment, and the required housing counseling education classes are proven to help buyers both prepare and achieve their goals of responsible homeownership. For families who do not currently qualify, financial education and counseling are offered to help prepare for future homeownership.”

Also in 2018, the program was further enhanced with the introduction of NeighborhoodLIFT Home Ownership Counseling Grants and another $2 million contribution from Wells Fargo to NeighborWorks to provide in-person credit counseling to homebuyers at no charge with a participating HUD-approved housing counselor in local NeighborhoodLIFT program communities including Charlotte, Orlando, Los Angeles, Mississippi and Washington, D.C.

Grant Money Available

Grant funds are still available for LIFT programs in Birmingham, Ala.; New Mexico; Mississippi; and Orlando, Fla. NeighborhoodLIFT program homebuyers can obtain mortgage financing from any qualified lender. Interested homebuyers can learn more about the program at wellsfargo.com/lift and a video about the program can be viewed on Wells Fargo Stories.

LIFT programs impact report by NeighborWorks America

An analysis of the impact of LIFT program homebuyers compiled by NeighborWorks America indicates:

-

Sixty-one percent of LIFT homeowners represent low- and moderate-income households, defined as those earning 80 percent or less of the area’s median income. The program helps level the playing field for working families who might not otherwise be able to save up for a down payment.

-

Among LIFT buyers surveyed, 42 percent pay less for housing than they did previously.

-

Eighty percent of LIFT participants stated that the homebuyer education services they received will help them manage their finances and sustain homeownership.

-

More than 60,000 potential homebuyers have received housing counseling from a NeighborWorks network member engaged in LIFT programs.

“NeighborhoodLIFT is a terrific collaborative success that makes homeownership achievable and sustainable,” said Kim Smith-Moore, Wells Fargo’s national LIFT programs manager. “The program has made a real difference in the lives of nearly 20,000 people and families — with the majority of them representing underserved, low- and moderate-income households — by helping them prepare to be successful homeowners.”

About NeighborWorks America

For 40 years, Neighborhood Reinvestment Corp., a national, nonpartisan nonprofit known as NeighborWorks America, has strived to make every community a place of opportunity. Our network of excellence includes more than 245 members in every state, the District of Columbia and Puerto Rico. NeighborWorks America offers grant funding, peer-exchange, technical assistance, evaluation tools and access to training, as the nation's leading trainer of housing and community development professionals. NeighborWorks network organizations provide residents in their communities with affordable homes, owned and rented; financial counseling and coaching; community building through resident engagement; and collaboration in the areas of health, employment and education. In the last five years, our organizations have generated more than $34 billion in investment across the country.

About Wells Fargo

Wells Fargo & Company (NYSE: WFC) is a diversified, community-based financial services company with $1.9 trillion in assets. Wells Fargo’s vision is to satisfy our customers’ financial needs and help them succeed financially. Founded in 1852 and headquartered in San Francisco, Wells Fargo provides banking, investment and mortgage products and services, as well as consumer and commercial finance, through 7,800 locations, more than 13,000 ATMs, the internet (wellsfargo.com) and mobile banking, and has offices in 37 countries and territories to support customers who conduct business in the global economy. With approximately 259,000 team members, Wells Fargo serves one in three households in the United States. Wells Fargo & Company was ranked No. 26 on Fortune’s 2018 rankings of America’s largest corporations. News, insights and perspectives from Wells Fargo are also available at Wells Fargo Stories.

###