Advanced Distribution Modernization Can Smooth the “Changing Physics” of the Grid

Utilities see advanced distribution modernization giving them more control

Let’s face it: The old days were much simpler, when the flow of power from the utility to end-user was, for the most part, a straight line. There were challenges, but there wasn’t much getting in the way between baseload power generation and the light switch.

Those days are gone. The influx of distributed energy resources (DER), electric vehicles and the resulting multi-directional power flow — sometimes from customer to utility (e.g., rooftop solar) — has flipped the script, even if one immutable truth remains: Your customers expect their power to always be on. Without a systematic approach to distribution modernization, these new technologies raise the potential for trouble on the grid, taxing our aging distribution infrastructure and putting the customer relationship at risk.

Download the ReportAdvanced distribution modernization sees utilities rapidly adopting digital technologies such as sensors, automated line switches, reclosers and regulators, plus advanced remote monitoring to give themselves more control and faster response to power flow issues. Applications such as fault location isolation and service restoration (FLISR) can be used to automatically detect, locate and isolate faults to limit the number of customers impacted and reduce restoration times, both key measures for reliability. Grid reliability and efficiency were top drivers for modernization efforts, according to respondents to Black & Veatch’s 2020 Strategic Directions: Smart Utilities Report survey.

Advanced grid programs such as volt/volt- ampere reactive (var) optimization dynamically and autonomously optimize voltage and reactive power to help utilities reduce peak demand, system losses and/or energy consumption and improve power quality and grid stability. The combination of distribution automation (DA) and analytic software offers expanded grid monitoring and management capabilities.

These adaptations are necessary at a time when the evolution of power generation and delivery is changing the physics of the grid. Firm generation sources such as coal and nuclear are giving way to cleaner yet intermittent and often volatile sources, many of which are controlled but not owned by the utility. These intermittent resources produce voltage swings that need to be monitored, resolved, forecasted and planned for.

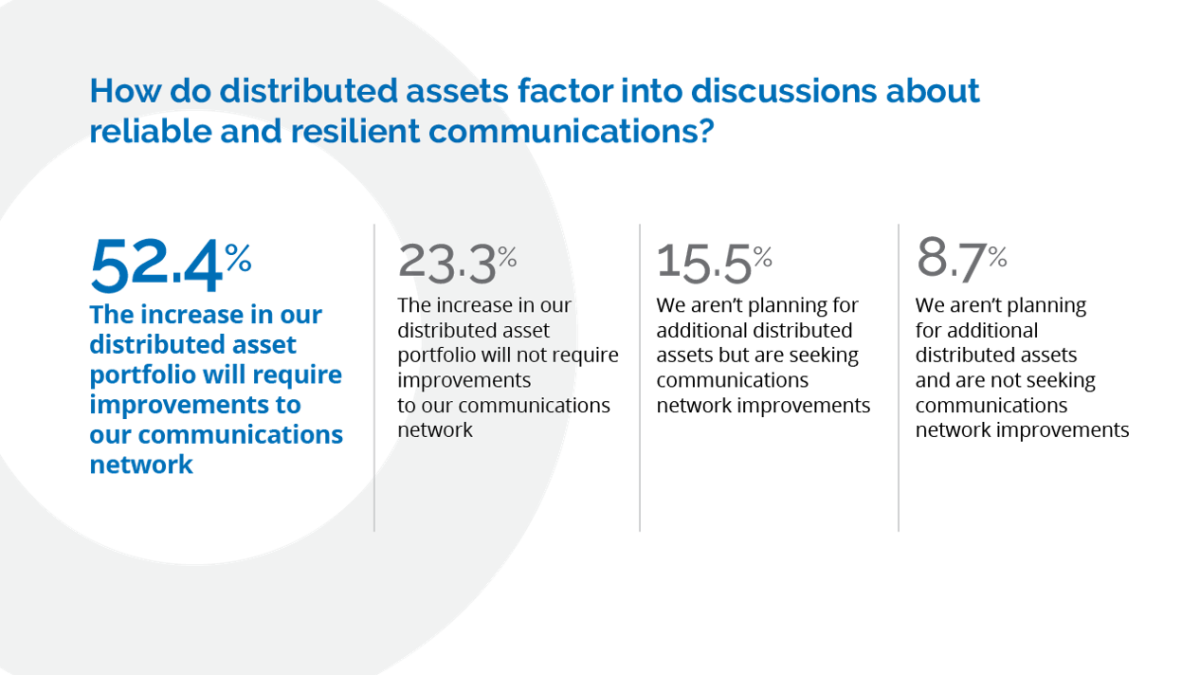

The distributed nature of utility assets is a significant factor as utilities plan for reliability and resilience, with 52 percent of respondents saying increases in their distributed asset portfolios will require communications network improvements.

We also can’t forget about the data flow accompanying this historic shift. In a matter of just a few years, our grid has gone from producing a teacup’s worth of data to an ocean. Devices provide the data that tells the story of our systems, and utilities are challenged to connect data from different sources, much like advanced metering infrastructure (AMI) connects with supervisory control and data acquisition (SCADA), to produce actionable information that can improve power quality, reliability and operational efficiency, and reduce cost.

Resource constraints remain critical inhibitors of comprehensive distribution modernization solutions, with more than half of survey respondents to Black & Veatch’s 2020 Strategic Directions: Smart Utilities Report citing budget, followed by competing priorities and regulatory hurdles.

Concerns about cost are understandable. Much of distribution modernization will involve taking a largely mechanical grid and digitizing it. Outdated mechanical breakers that have been the hallmark of today’s aging infrastructure have been operating for 30 to 50 years, but new DER are testing the grid’s limits, wearing out breakers and raising risk.

For example, during sunny summer days, solar arrays may produce more distributed energy than the system can use. If that load on the grid isn’t balanced, power would return upstream through the substation and back into transmission, which causes instability that cascades into rolling blackouts. Utilities need a more robust grid with remote control and monitoring capability that features asset management health checks and moves operations and maintenance into a proactive approach rather than the outdated reactive mode.

In addition, Black & Veatch is seeing some utilities break their distribution feeders into switchable segments that allow automated rerouting of power around faults. For this approach, AMI proves particularly valuable, because along with delivering data (i.e., consumption data and power-quality metric), AMI can enable time-based rates and targeted load shedding to deliver a non- wire means of deferring grid upgrades and investments.

That ability may be why AMI ranked a close second to SCADA on the priority list. Newer AMI meters can provide high-quality data because strategic meter placements around the distribution system can serve as bellwethers to voltage spikes or dips. Using data to analyze blink counts can identify feeders with high transient outages so that crews can investigate the cause.

Now that fuses and other tie points are being automated to SCADA, AMI and FLISR, most if not all device and application solutions will require advanced telecommunications systems and data analytics. It will be critical for organizations to chart an upgrade course that accommodates a diverse and ever-evolving grid — paired with ways to analyze and act on what these devices are telling us.