Clarivate Analysis of Water Sector Innovation Enables Future Water Association To Make Data-Driven, Industry Changing Recommendations

Following a successful engagement with Derwent™, part of Clarivate, to assess innovation intensity within the water sector, Future Water Association (FWA) presented data-driven, industry changing recommendations to an influential audience at its “Transformation of the Water Sector” event held at the Institution of Civil Engineers headquarters in London last year. FWA engaged Derwent in response to the recent demand from Ofwat, the United Kingdom’s economic regulator of the water industry, that water companies drive transformational change.

Ofwat is requiring ‘transformational change’ to respond to the urgency of pressures facing the industry. For example, PwC, a leading industry commentator, has identified several pressures to innovate, including market forces, changing weather patterns and national expectations, as new ‘smart’ technologies, including digitization emerge.

Measuring research innovation

The United Kingdom water industry has always aspired to be at the forefront of innovation but there was little data to prove its position. The Derwent engagement set out to address this.

A provisional look at scientific publication data suggests that the United Kingdom does play a leading role in original idea creation (see table 1).

|

Country/region |

Scientific publications (1996-2018) “water science and technology” |

|

United States |

113,316 |

|

Mainland China |

51,662 |

|

Germany |

29,413 |

|

United Kingdom |

28,300 |

|

Canada |

21,305 |

|

France |

20,104 |

|

India |

19,290 |

|

Australia |

17,640 |

|

Japan |

14,330 |

|

Spain |

13,019 |

Table 1. Scientific publications in “water science and technology.”

Source: Web of Science, from Clarivate Analytics

While scientific publications demonstrate fundamental research, the more interesting question is how many of these ideas translate into industrial application with the funding behind them to generate commercial returns on the R&D investment, so the Derwent team turned to look at patent data.

Patent analysis reveals Mainland China’s leadership in waste water management innovation

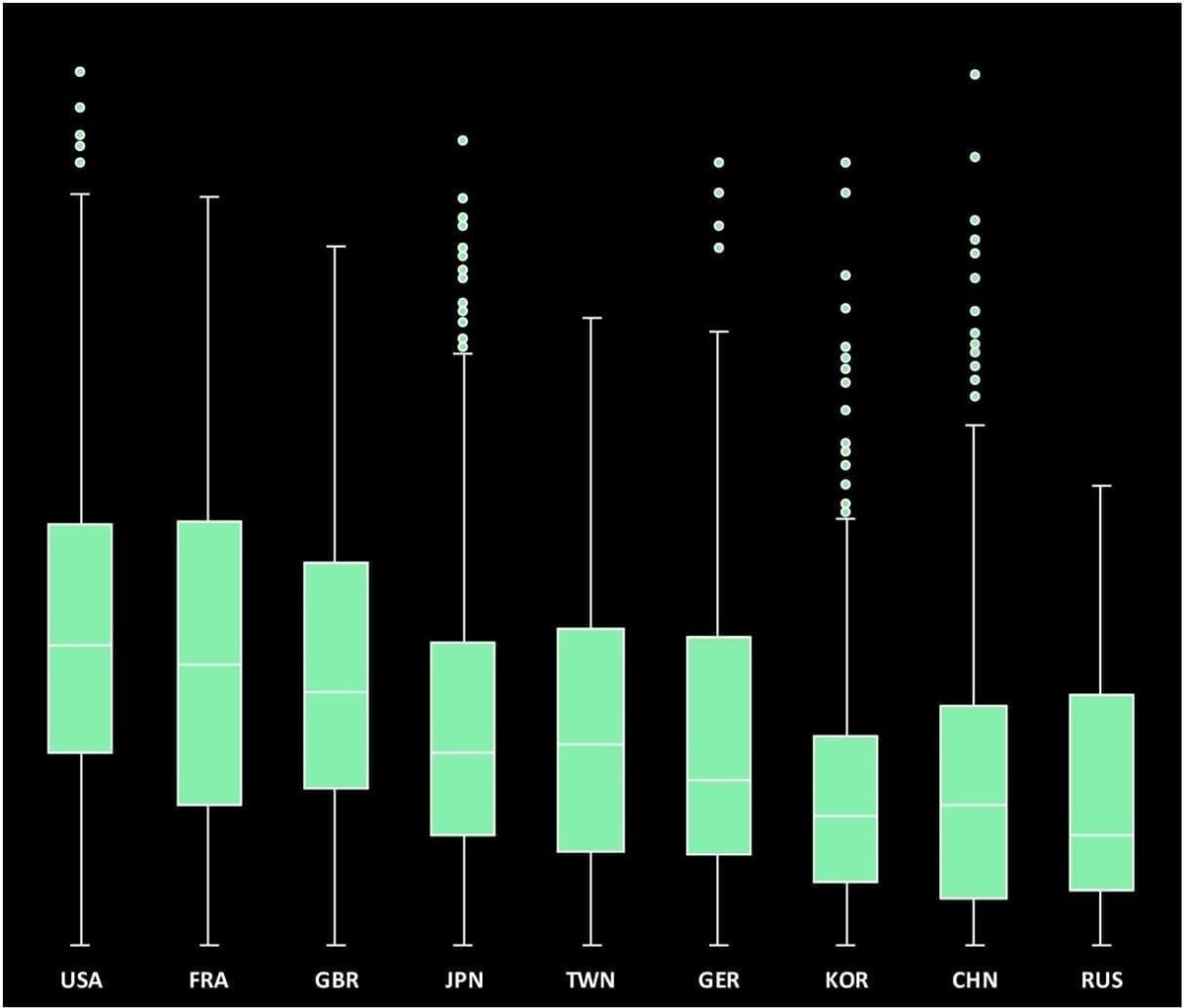

Using the Derwent World Patents Index™ (DWPI), the world’s most comprehensive database of enhanced patent information, structured by inventions and our proprietary scoring methodologies, the team demonstrated that the United Kingdom produces a high quality portfolio of inventions when it came to established technologies in “waste water management” (see Chart 1).

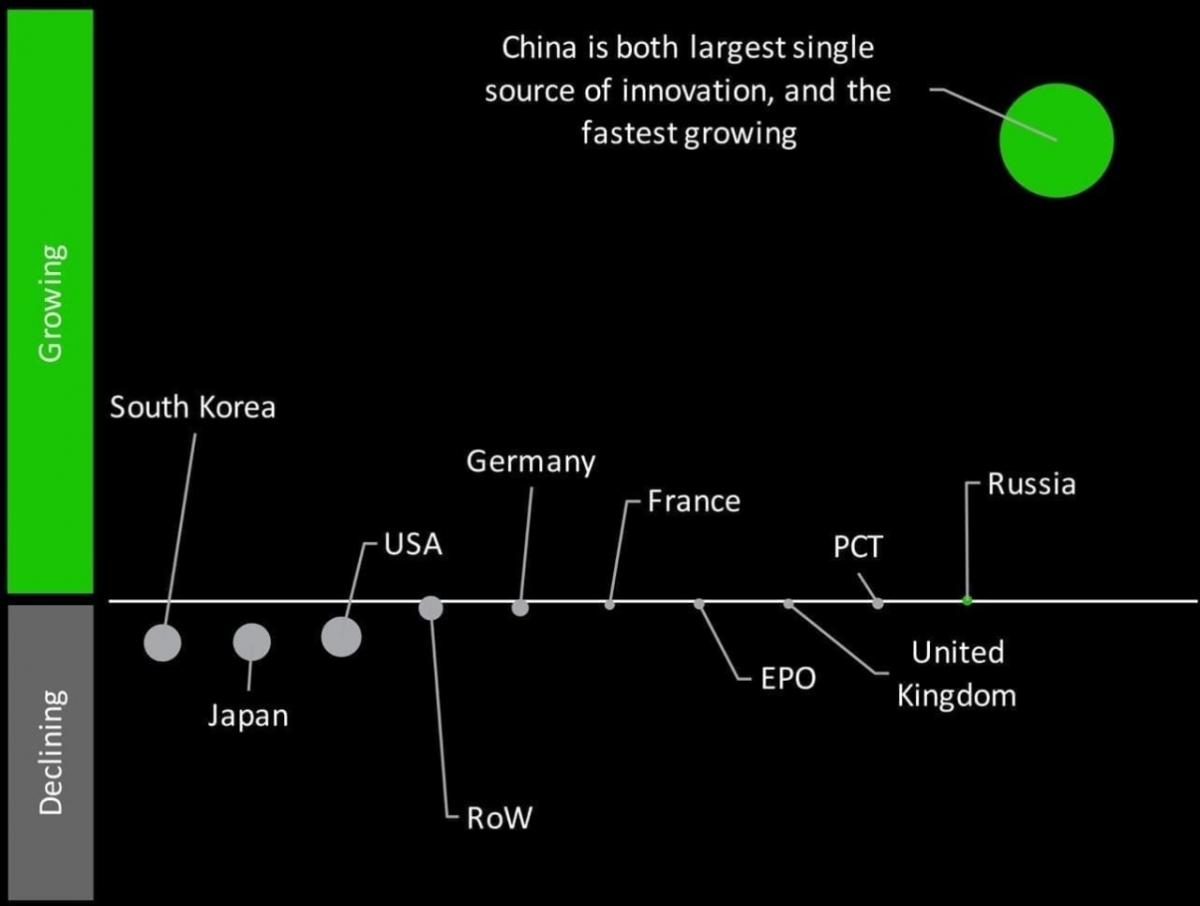

However, the U.K. and other major global economies do not hold a similar position when analyzing volume and growth of inventions. As demonstrated in Chart 2, the Derwent team’s analysis of patented inventions from 2006 to 2018 in the field of waste water management revealed:

-

the small contribution of inventions made by the U.K.;

-

the large contribution of inventions made by Mainland China (69% of all waste water management inventions since 2006 originated from Mainland China); and

-

the ineffective competition against Mainland China made by the rest of the world, including major economies such as the U.S., Japan and South Korea.

Mainland China continues its lead in smart technologies

So, if the U.K. and other major economies are not focused on established technologies in waste water management, perhaps they have switched their focus to the key smart technologies that PwC highlighted? Because digitization is a core innovation theme across many sectors, including the water sector (it’s the interface between the “hi-tech” and “water” sectors), the Derwent team examined “remote sensing” inventions relating to water.

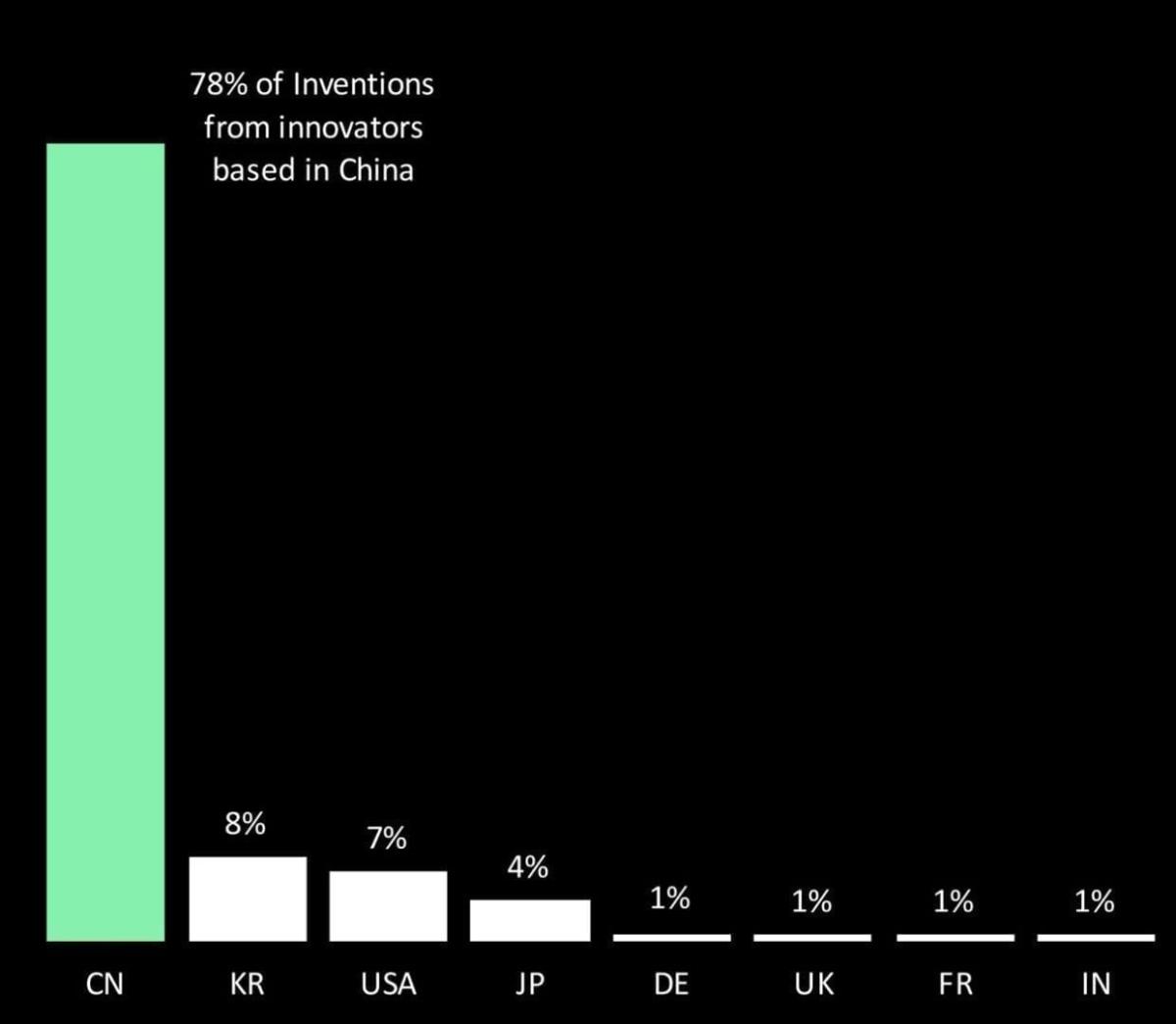

When analyzing remote sensing inventions related to water, analysis of the Derwent data shows that Mainland China holds an even more commanding lead, originating 78% of all inventions in this field (see Chart 3). While many will be quick to point out that perhaps not all of those inventions are defended by high quality patents and that many are presently only filed in Mainland China, as shown in Chart 1, the data nevertheless demonstrates that Mainland China does generate many very high quality, internationally reaching patent protected inventions.

The findings show that while the U.K. is conducting a fantastic job of enablement, it is failing to convert primary research into commercially rewarding and legally protected assets. The commercial rewards, if obtained correctly, could provide for reinvestment into future technologies.

The information needed to deliver data-driven, industry changing recommendations

Armed with these and more insights from Clarivate, FWA held an event to raise these insights to the leading innovators within the U.K. water sector.

FWA’s recommendations included:

-

The U.K. water industry, supported by the government, should use patent analytics to undertake a detailed review of the water sector, focusing on the U.K. and comparing its track record internationally and to the oil and gas sector.

-

The U.K. government, through the water industry regulator Ofwat should set a regulatory target linked to patent activity as one of the innovation metrics.

-

An organization should be established to strengthen IP protection and act as a catalyst for innovation uptake in the U.K. water industry. This organization would manage the IP where this is of common interest to the sector, while also benefiting those developing the ideas.

-

The government, with Ofwat and the water utilities, should develop a ‘sector-wide’ innovation strategy that all stakeholders sign up to (academia, water companies, supply chain, etc.), around which innovations can be formalized.

Between the evidence produced, FWA’s recommendations and the strong engagement at the event, there is the possibility to change how the U.K. water sector approaches innovation at governmental, regulatory and collaborative levels.

Learn more about the Clarivate commitment to sustainability.