Green Bond-anza: Making Sense of the Categories

Green Bond-anza: Making Sense of the Categories

By Benjamin J. Bailey, Praxis Mutual Funds & Everence Financial

With the recent announcement that the European Union will begin issuing green bonds starting in October of 2021 and predictions that have annual green bond issuance hitting $1 trillion by 2023, many have been left wondering: “What exactly is a green bond?”

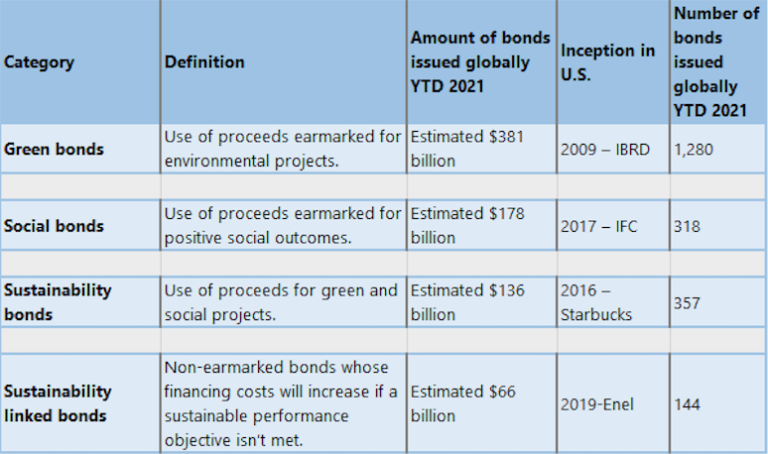

Green bonds allow investors to buy bonds that make a specific impact on the environment, often with specific attention to climate. Green bonds first came to the U.S. market in 2009 with an International Bank for Reconstruction and Development (IBRD) issuance. The green bond market started slowly, but a slow and steady start has led to the strong and diverse market of today. Successes in the green bond space later led to the introduction of social and sustainability bonds. Recently, the issuance of positive impact bonds has grown to include new categories, such as blue bonds and sustainability-linked bonds.

For many investors and clients, it can be exciting to learn that by actively lending to issuers who are making a positive impact, they are able to support a variety of life-altering causes such as bettering the Earth’s air quality, educating children, providing affordable housing and more. Traditionally, investors who wanted to make an impact were more likely to “screen out” bonds that had negative societal impacts. However, investing in positive impact bonds allows investors to make a greater, more diverse and more intentional impact.

Read about Current Trends in the Green Bonds Space and more in Benjamin's full article here - https://greenmoney.com/green-bond-anza-making-sense-of-the-categories