T. Rowe Price's Judy Ward Offers 7 Tips on How to Close the Gender Gap in Retirement Savings

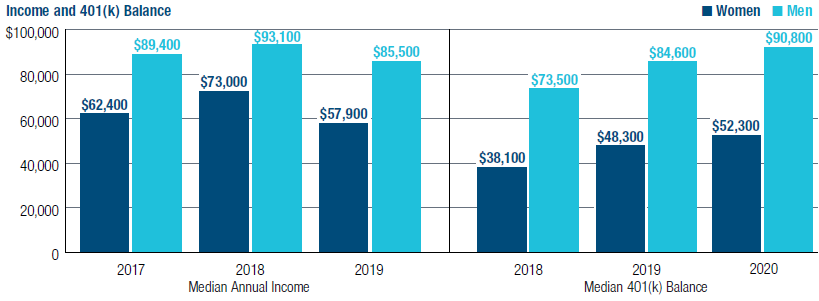

The wage and lifetime income gaps between men and women present many challenges for women preparing for retirement. “While there is progress among women saving for retirement, the gap between men’s and women’s retirement savings persists,” says Judith Ward, CFP®, a senior financial planner with T. Rowe Price. “It’s a likely follow through resulting from lower lifetime earnings.” As a result, women are contributing less to their 401(k)s than their male counterparts at a median % of income: 6% versus 10% for baby boomers, 6% versus 10% for Gen X, and 6% versus 8% for millennials, respectively.* What’s more, women typically live longer than men and will therefore need more in savings to support themselves throughout their retirements.

While the largest income and saving disparity is among working baby boomers who are on the cusp of retirement, savings behaviors among younger generations of women are also concerning. In a nutshell, lower salaries coupled with lower contribution rates have resulted in lower retirement account balances. The following tips can help women strengthen their financial footing and make more informed financial decisions.

* Source: 2020 T. Rowe Price Retirement Savings and Spending study.