New G&A Institute Research Shows Sustainability Reporting by Largest U.S. Public Companies Reached All-Time Highs in 2021

96% of S&P 500® Companies and 81% of Russell 1000® Companies Published ESG Reports; SASB Became Most Used Reporting Standard

New G&A Institute Research Shows Sustainability Reporting by Largest U.S. Publi…

NEW YORK, November 16, 2022 /3BL Media/ - Governance & Accountability Institute, Inc. (G&A), a leading consulting firm on corporate sustainability and ESG, today announced the findings of its 2022 Sustainability Reporting in Focus research on companies in the S&P 500® Index and the Russell 1000® Index. This marks the 11th annual report in G&A’s research series tracking the publication of sustainability reports by the largest U.S. publicly-traded companies.

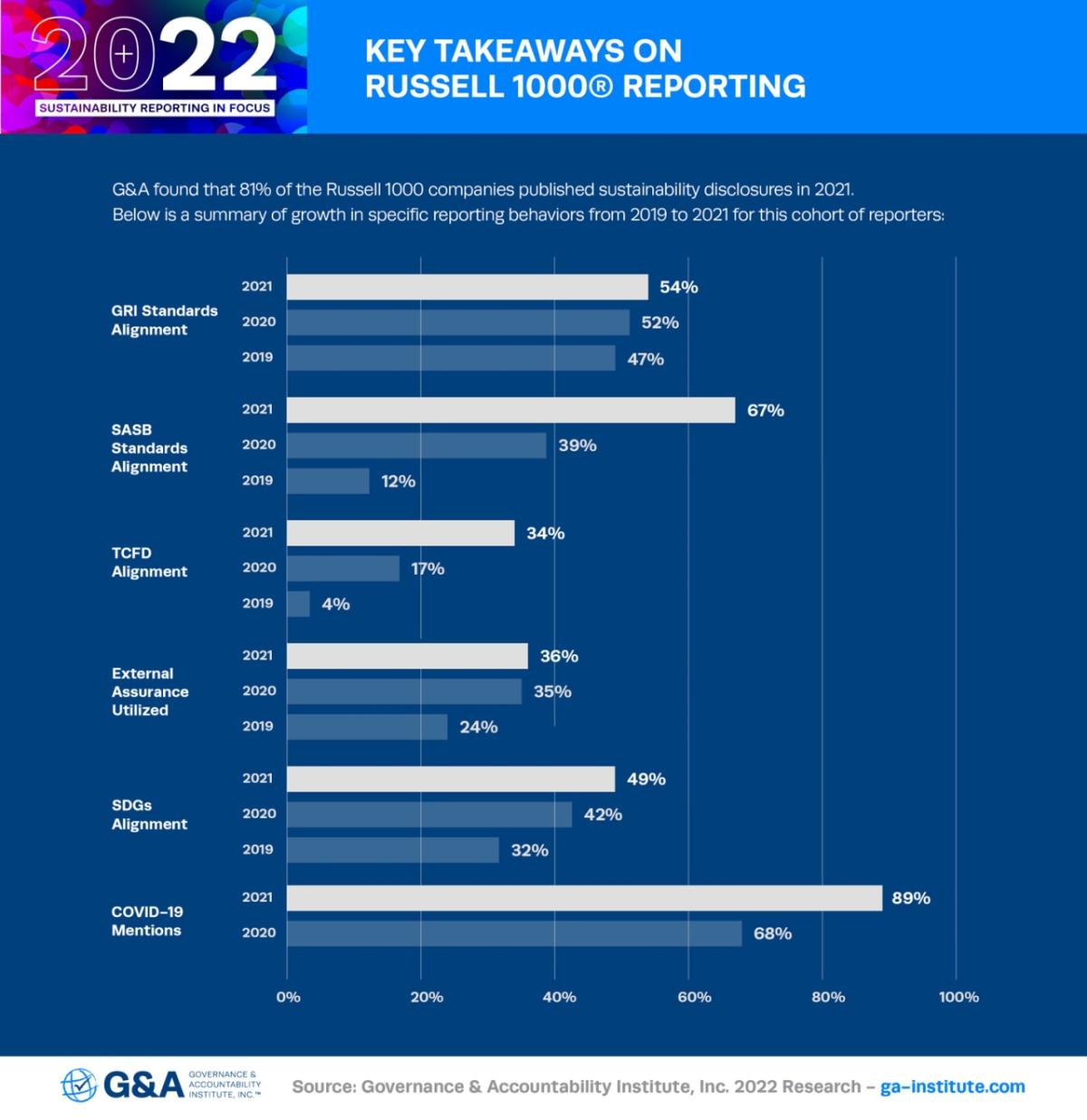

G&A’s 2022 Sustainability Reporting in Focus research showed all-time highs across the board in sustainability reporting for the Russell 1000 companies in 2021. Key takeaways from G&A’s research include:

- 81% of Russell 1000 companies published a sustainability report in 2021, an impressive increase from 70% in 2020

- The smallest half by market cap of the Russell 1000 index saw the largest increase in reporting with 68% publishing a report in 2021, up substantially from 49% in 2020

- The largest half of the Russell 1000 index (i.e., the S&P 500 companies) is nearing 100% reporters with 96% publishing a report in 2021, an increase from 92% in 2020

- For the first time, SASB was the most-used reporting standard in 2021 among the Russell 1000, with 67% of sustainability reports aligning with SASB compared to 54% aligning with GRI

- The use of TCFD doubled among Russell 1000 companies in 2021, with 34% of sustainability reports aligning with TCFD compared to 17% in 2020

- 89% of sustainability reports published by Russell 1000 companies in 2021 discussed the impact of the COVID-19 pandemic

(See graphic represeentation of the data noted above.)

Click here to read the full report for more comprehensive reporting breakouts and details on the S&P 500 and Russell 1000 companies.

Louis Coppola, G&A’s Executive Vice President and Co-Founder, commented, “The results of our 2022 research clearly demonstrate that sustainability reporting has become a best practice among the largest U.S. publicly-traded companies. The percentage of S&P 500 companies publishing sustainability reports is nearly 100% and reporting by the smaller half of companies in the Russell 1000 doubled between 2018 and 2021. We believe these trends highlight the importance of ESG and sustainability to investors and other key stakeholders, as well as the desire of public companies to demonstrate accountability and transparency to these stakeholders. When seeing these results, you have to wonder – just what are the 4% of non-reporters in the S&P 500 waiting for?”

Hank Boerner, G&A’s Chairman, Chief Strategist and Co-Founder, added, “G&A’s 2022 research continued to see increased use of newer reporting frameworks like TCFD, as well as alignment with climate initiatives like SBTi and CDP. We believe this is being driven by increased stakeholder focus on climate change impacts and the potential mandate of emissions reporting by the U.S. Securities and Exchange Commission. We continue to work with publicly-traded companies to help them manage ever-changing reporting frameworks and standards, along with changes to disclosure regulations in the U.S. and around the world.”

In 2012, G&A’s analysts published our first report on sustainability reporting trends of the S&P 500 companies for the publication year 2011, which showed just 20% of S&P 500 companies publishing sustainability reports or disclosures. G&A expanded this research in 2019 to include all companies in the Russell 1000 Index, finding that 60% of Russell 1000 companies published sustainability reports in 2018. In the bottom half of the index by market cap, only 34% published sustainability reports that year. These percentages have increased each year since then and reached all-time highs in 2021 as 96% of S&P 500 companies, 81% of Russell 1000 companies, and 68% of the bottom half by market cap of Russell 1000 companies published sustainability reports.

G&A’s 2022 Sustainability Reporting in Focus report analyzes the content of the identified reports to provide detailed breakdowns of reporting frameworks and standards used (GRI, SASB, TCFD), alignment with initiatives such as SBTi and the United Nations SDGs, and trends in external assurance and CDP reporting. The report also includes a breakout of non-reporters in the S&P 500 and Russell 1000 by sector.

ABOUT THE G&A TEAM CONDUCTING THE 2022 SUSTAINABILITY REPORTING IN FOCUS RESEARCH

G&A proudly recognizes our research team of talented analysts who made significant contributions to this study:

G&A Research Supervisor: Elizabeth Peterson, G&A Vice President, Sustainability Consulting

Intern Team Leader: Keerthana Ramasamy Thirugnana Sambantham

Honor Roll Intern Analysts:

- Janis Arrojado

- Gia Hoa Lam

- Lauryn Power

- Noelani West

For more information on our team of research analysts please click here.

ABOUT GOVERNANCE & ACCOUNTABILITY INSTITUTE, INC.

G&A is a sustainability consulting and research firm headquartered in New York City, advising corporations and investors on executing winning strategies that maximize return on investment at every step of their sustainability journey.

Founded in 2006, G&A helps corporate and investor clients recognize, understand, and develop strategies for sustainability and ESG issues to address stakeholder and shareholder concerns. G&A’s proprietary, comprehensive 5-Step Process for sustainability reporting is designed to help organizations achieve sustainability leadership in their industry and sector.

G&A served as the Data Partner for the Global Reporting Initiative (GRI) in the U.S., U.K., and the Republic of Ireland from 2011 to 2020. In this role, the G&A team analyzed more than 9,000 sustainability reports and catalogued tens of thousands of important data points for these reports. G&A continues to examine sustainability reports from the largest U.S. publicly-traded companies and maintains a comprehensive database of reporting data to help steer strategy for our clients and improve their disclosure and reporting.

ABOUT THE S&P 500®

The S&P 500 is widely regarded as one of the best gauges of large-cap U.S. equity market performance, measuring the stock performance of approximately 500 large-cap companies covering approximately 80% of available market capitalization on U.S. stock exchanges. There is an estimated US$15.6 trillion in assets indexed or benchmarked to the index as of Dec. 31, 2021. The S&P 500 is owned by S&P Dow Jones Indices, a division of S&P Global. More information is available here.

ABOUT THE RUSSELL 1000®

The Russell U.S. Indexes are market-weighted indices that serve as leading benchmarks for institutional investors to track current and historical market performance by specific market segment (large/mid/small/micro-cap) or investment style (growth/value/defensive/dynamic).

The Russell 1000 Index includes the largest publicly-traded U.S. companies by market cap, which make up approximately 93% of the total market capitalization of all listed stocks in the U.S. equity market. The indices/benchmarks are provided by FTSE Russell, a wholly owned subsidiary of the London Stock Exchange Group (LSEG). More information is available here.

CONTACT:

Louis D. Coppola, Executive Vice President & Co-Founder

Governance & Accountability Institute, Inc.

Tel 646.430.8230 ext 14

Email: lcoppola@ga-institute.com